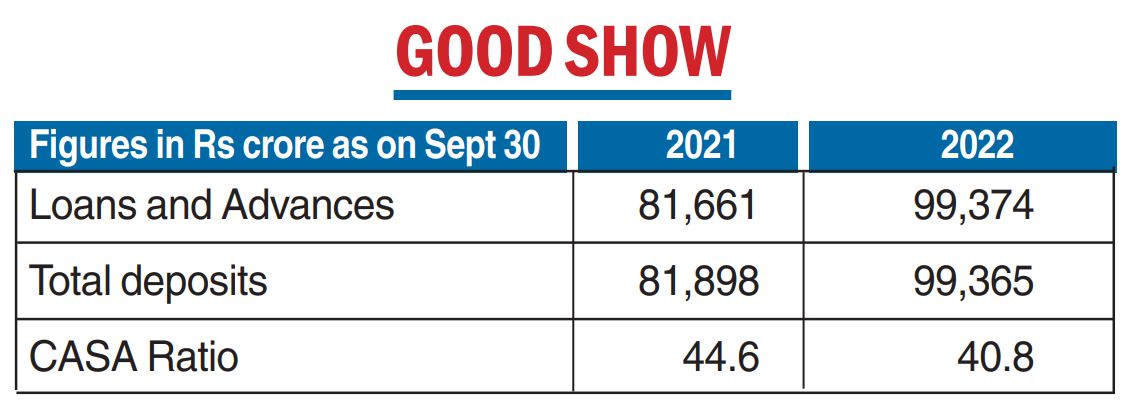

Bandhan Bank on Saturday said its total loans and advances have seen a 22 per cent growth to Rs 99,374 crore as on September 30 compared with Rs 81,661 crore as on September 30, 2021.

The growth in total advances (before considering writeoffs) is higher than the 20 per cent year-on-year growth recorded on June 30 and comes on the back of stable collection efficiency.

The pan bank collection efficiency excluding NPA but including restructuring customers was at 97 per cent in September compared with 96 per cent in June. The collection efficiency in the emerging entrepreneurs’ business (microfinance) was at 95 per cent, a marginal improvement from 94 per cent in June.

Total deposits grew 21 per cent to Rs 99,365 crore as of September 30 on a year-on-year basis and 7 per cent on a quarter-on-quarter basis. While retail deposits (including CASA) grew 7 per cent, there was a sharp increase of 96 per cent in bulk deposits on a year-on-year basis and 28 per cent on a quarter-on-quarter basis.

The CASA ratio was at 40.8 per cent as of September 30 compared with 44.6 per cent as on September 30, 2021.

The share of microfinance loans has been on the decline from 86 per cent in FY2019 to 44 per cent as of the April-June quarter of FY23 and the bank has set a target of bringing it down to 26 per cent by FY2025.