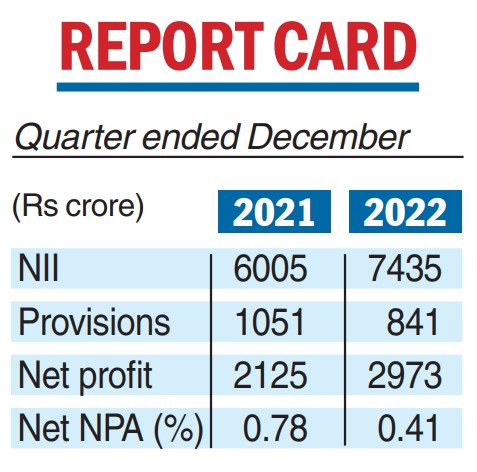

Bajaj Finance on Friday reported strong numbers for the third quarter ended December 31 with consolidated net profit rising 40 per cent to Rs 2,973 crore from Rs 2,125.29 crore in the same period of the previous year.

This is the highest ever quarterly profit reported by the non-banking finance company.

During the quarter, core net interest income (NII) rose 24 per cent to Rs 7,435 crore from Rs 6,005 crore in the same period of the previous year.

The loan losses and provisions during the quarter stood at Rs 841 crore against Rs 1,051 crore in the year-ago period.

Bajaj Finance added that the percentage of gross non-performing assets (NPA) and net NPA as of December 31 stood at 1.14 per cent and 0.41 per cent, respectively, against 1.73 per cent and 0.78 per cent as of December 31, 2021.

The company’s capital structure continued to remain strong with the capital adequacy ratio (including Tier-II capital) standing at 25.14 per cent at the end of the quarter. Of this, the core Tier-I capital was 23.28 per cent.

Commenting on the advances front, Bajaj Finance said new loans booked during the quarter were highest ever at 7.84 million.

The company said it added 3.14 million new credit customers during the October-December quarter and 7.84 million so far this fiscal, making this the highest-ever for the non-banking lender focused on retail finance, taking its total customer franchise to 66.05 million, up 19 per cent from 55.36 million in December 2021.

The assets under management (AUM) were at Rs 230,842 crore during the quarter compared with Rs 181,250 crore, marking a rise of 27 per cent.

While the results were announced after market hours, the Bajaj Finance stock ended at Rs 5,756, a drop of Rs 40.90 over the previous close on the BSE.