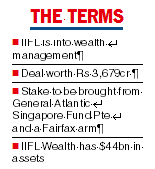

Bain Capital, the global private multi-asset alternative investment firm, is acquiring a 24.98 per cent stake in IIFL Wealth Management Ltd for Rs 3,679 crore.

This stake will be acquired from General Atlantic Singapore Fund Pte Ltd and FIH Mauritius Investments Ltd, a wholly owned subsidiary of Fairfax India Holdings Corporation. The transaction is subject to regulatory and other customary approvals. While this transaction values IIFL Wealth at almost Rs 14,728 crore, its shares gained at the stock exchanges on the announcement. On the BSE, the scrip closed at Rs 1,671.30 — a rise of Rs 4.80 resulting in a market capitalisation of Rs 14,826 crore.

IIFL Wealth which is one of the leading wealth and alternative asset managers in India has around $44 billion in assets (as on December 31, 2021).

Founded by first generation entrepreneurs, Karan Bhagat, MD & CEO, IIFL Wealth and Yatin Shah, joint-CEO, IIFL Wealth, in 2008, the company serves the needs of high net worth and ultra-high net worth individuals, family offices, and institutions through a range of solutions.

“Since our inception 13 years ago, we continue to service our clients with unflinching commitment to innovation, consistency, transparency as well as to provide a trusted platform for all their wealth and asset management needs. Bain Capital’s investment is a testament to our strong leadership franchise in the financial services space, and in our team’s ability to continue to execute and grow the business to scale. We look forward to having them on board’’, Karan Bhagat said.

“They (IIFL Wealth) have built the premier brand in wealth and asset management in India on the back of innovation, customer centricity and consistent performance. The company is well poised to benefit from secular tailwinds of wealth creation in the economy, greater financialisation and increasing penetration of formal wealth management,’’ Pawan Singh, managing director at Bain Capital, said.