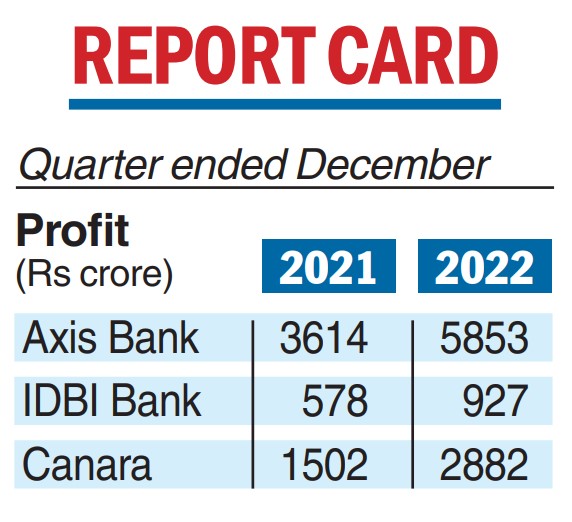

Private sector lender Axis Bank on Monday reported a 62 per cent surge in profit at Rs 5,853 crore for the quarter ended December, driven by an increase in net interest income and a decline in bad loans.

Net profit on standalone basis stood at Rs 3,614 crore in the same quarter of the previous financial year.

Total income increased to Rs 26,892 crore in the quarter from Rs 21,101 crore in the year-ago period, the bank said in a regulatory filing.

Net interest income rose by 32 per cent to Rs 11,459 crore. The net interest margin (NIM) increased to 4.26 per cent.

The bank’s operating profit grew 51 per cent on an annual basis to Rs 9,277 crore.

On the asset quality front, the bank recorded an improvement with gross NPAs (non-performing assets) declining to 2.38 per cent of the gross advances compared with 3.17 per cent at the end of the third quarter of 2021-22.

Net NPAs too eased to 0.47 per cent from 0.91 per cent.

Despite a decline in bad loans, provisions and contingencies increased to Rs 1,437.73 crore from Rs 1,334.83 crore in the same period a year ago.

During the quarter ended December 31, the bank issued Basel III compliant Tier II bonds of Rs 12,000 crore.

The capital adequacy ratio rose to 17.60 per cent in the December quarter from 17.44 per cent a year ago.

“India is emerging from the after-effects of the Covid19 virus, a global pandemic that has affected the world economy over the last two years. The extent to which any new wave of Covid-19 will impact the bank’s operations and asset quality will depend on future developments, which are highly uncertain,” it said.

IDBI Bank

Privatisation-bound IDBI Bank on Monday reported its best-ever quarterly numbers, with a 60 per cent jump in net income at Rs 927 crore for the December quarter on all-round growth in core business and a massive reduction in bad loans along with a near record margin.

The management, controlled by the national insurer LIC, has guided towards better overall numbers in the March quarter, pencilling in an under-10 per cent gross NPA (non-performing assets) by the end of this fiscal.

Rakesh Sharma, the managing director of the lender, said the quarterly profit is primarily driven by core business growth as all other income streams, be its fee income or investment gains or even recoveries from written-off assets, have performed below par.

Canara Bank

Canara Bank on Monday reported a 92 per cent jump in profit at Rs 2,882 crore for the quarter ended December, helped by a rise in interest income and a decline in bad loans.

Net profit stood at Rs 1,502 crore in the same quarter of the preceding financial year.

Total income increased to Rs 26,218 crore from Rs 21,312 crore in the year-ago period, the state-owned bank said in a regulatory filing.

Interest income rose to Rs 22,231 crore against Rs 17,701 crore in the same quarter a year ago.

On the asset quality front, the bank recorded an improvement with gross NPAs (non-performing assets) declining to 5.89 per cent compared with 7.80 per cent at the end of the third quarter of 2021-22.