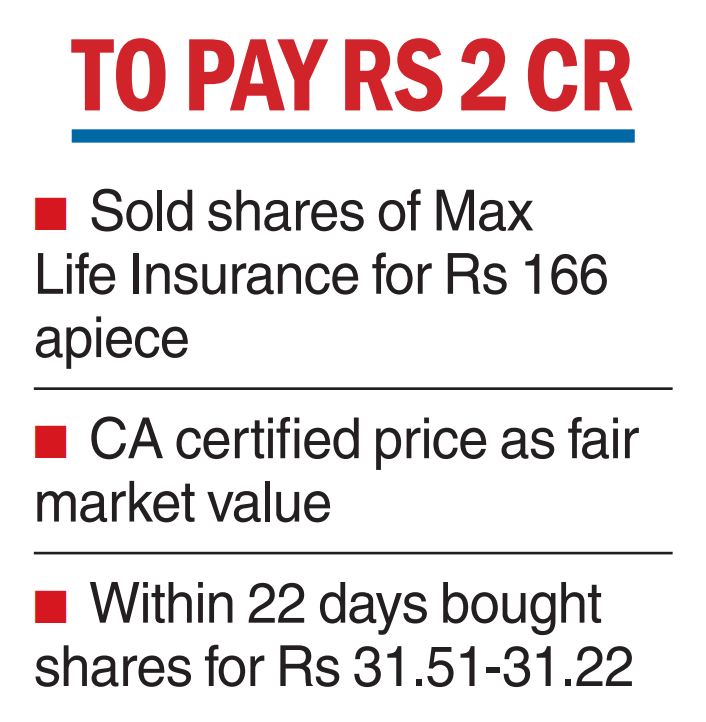

The Insurance Regulatory and Development Authority of India (IRDAI) has imposed a penalty of Rs 2 crore on Axis Bank for the violation of the regulator’s direction, misrepresentation to obtain approval and contravention of share transfer directions.

The matter pertains to a deal between Axis Bank and Max Life Insurance Company (MLIC). Axis Bank is the corporate agent for the insurer.

MLIC had sought the regulator’s nod for Axis Bank along with group firms — Axis Capital and Axis Securities — proposing to acquire 12 per cent of the stake held by Max Financial Services Ltd (MFSL) in the insurer.

The IRDAI said that while processing the application, the promoters of the insurer — MFSL and Mitsui Sumitomo Insurance Company (MFSI) — had a series of purchase and sale transactions with Axis. It added that these promoters engaged in the transfer of shares to Axis at a price substantially lower than the fair market value (FMV).

The IRDAI said Axis Bank had sold 0.998 per cent of equity shares for Rs 166 per share FMV based on the certificate of a chartered accountant.

Subsequently, Axis Bank and its group companies bought 12.002 per cent within 22 days at a price range of Rs 31.51-32.12 apiece, based on valuation under Rule 11UA of Income-tax Rules, 1962. Thus, there was no uniform basis for the determination of the price for the transfer of shares.

According to the regulator, this was not in compliance with the directions issued by it, wherein it was directed that the “basis for determining or calculating the FMV for allotment of shares, transfer of shares among the shareholders needs to be clear and needs to be uniformly followed’’.

ICICI Pru tie-up push

Calcutta: ICICI Prudential Life Insurance sees an expansion opportunity with the insurance regulator IRDAI proposing up to nine tie-ups between corporate agents such as banks and insurance companies.

“The exposure draft of regulator IRDAI says that corporate agents can tie up with nine life insurers instead of three. I see it as a great opportunity because we are used to not just working with ICICI Bank but also working with 30 banks now.”

“That itself should give us good entry into this new opportunity and that is something we will do in a focused manner,” said N.S. Kannan, MD and CEO, ICICI Prudential Life Insurance, said at the quarterly earnings call.

In the first six months of 2022-23, the share of annual premium equivalent sourced by ICICI Prudential through the bancassurance channel is 31.9 per cent. Of this, 18.1 per cent is through ICICI Bank and 13.9 per cent is through other banks.

“We continue to maintain our objective of doubling FY19 VNB (value of new business premium) by the end of this fiscal which requires a growth of around 23 per cent for the whole of the year,” Kannan added.

A STAFF REPORTER