Shares of Axis Bank fell up to 3.70 per cent on the bourses on Thursday after the government said it will sell its entire stake in the private sector lender.

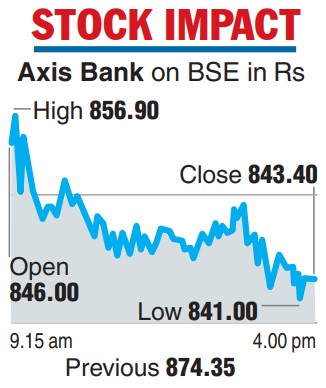

The stock declined 3.54 per cent to end at Rs 843.40 on the BSE, while it slipped 3.70 per cent on the NSE to close at Rs 841.40. In volume terms, 4.85 lakh shares were traded on the BSE and over 1.89 crore units on the NSE during the day.

On Wednesday, the Specified Undertaking of the Unit Trust of India (SUUTI), under the Union government, said it plans to sell 4.65 crore shares representing a 1.55 per cent stake in Axis Bank.

With the sale, the Centre would completely exit Axis Bank. As of September, SUUTI held 4,65,34,903 shares, representing a 1.55 per cent stake in the bank.

At the current market prices, the government is expected to realise about Rs 4,000 crore from the share sale. In May last year, it sold a 1.95 per cent stake in Axis Bank for about Rs 4,000 crore.

Brokerages are, however, optimistic about the stock, particularly after its second-quarter results.

On a standalone basis, the lender had reported a 70 per cent rise in net profits for the quarter that ended September 30 at Rs 5,329.77 crore. Core net interest income rose 31 per cent to Rs 10,360 crore.