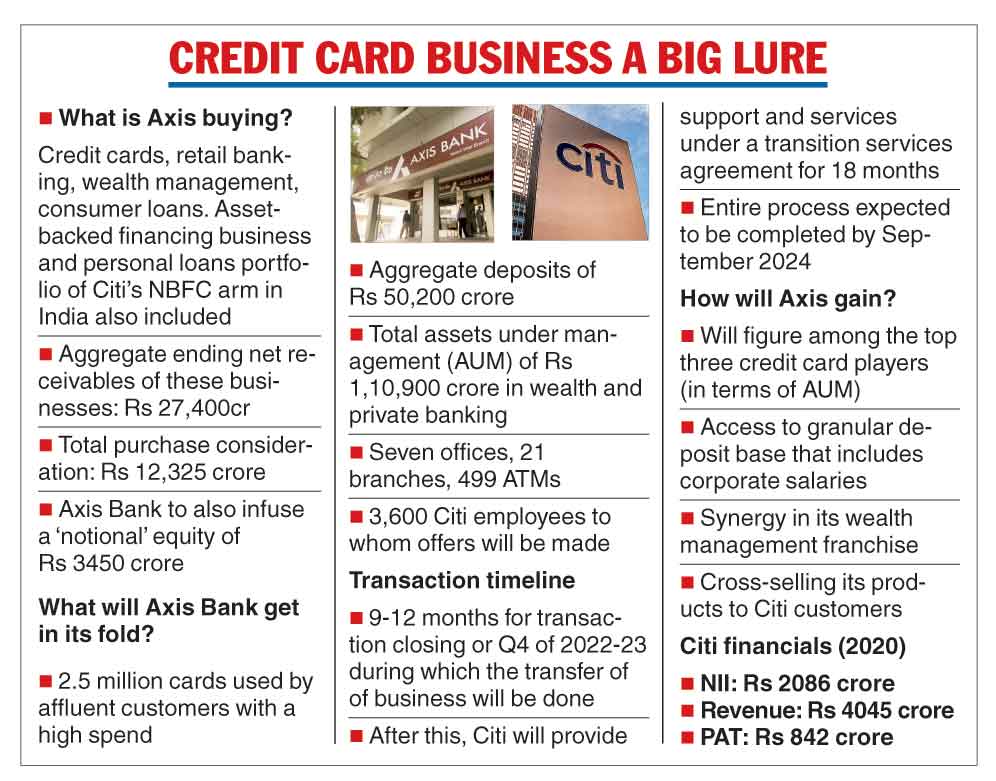

Axis Bank has struck a deal to acquire the consumer business of Citi India, including its lucrative credit card portfolio, for Rs 12,325 crore ($ 1.6 billion).

The country’s third largest private sector lender will also take over Citi India’s retail banking, wealth management and consumer loans business.

The consumer business of Citi India’s non-banking finance company, Citicorp Finance (India) Ltd, also forms part of the deal. This operation comprises an asset-backed financing business like commercial vehicles, construction equipment loans and a separate personal loans portfolio.

“A transaction of this nature comes once in a lifetime… this acquisition will provide us access to perhaps the best affluent customer franchise in India,” Axis Bank MD and CEO Amitabh Chaudhry told reporters at a press conference.

In April last year, Citigroup Inc had said it intended to exit retail banking in 13 markets including India after a review of its global strategy.

The portfolio size (excluding deposits) of the India retail business currently stands at around Rs 27,400 crore.

The proposed transaction is expected to close in the fourth quarter of 2022-23 by which time regulatory approvals and customer consent are expected to come through.

The businesses are being acquired as going concerns without assigning values to individual assets and liabilities, Axis Bank said.

“The transaction will include approximately 3,600 Citi employees supporting the consumer businesses in India, who will transfer to Axis upon completion of the proposed transaction,” the US-based bank said in a separate statement.

Axis Bank said it would make employment offers either on the existing terms or even sweeten it if it wants to retain key employees.

Over the next 18 months, Axis Bank will focus on integrating the technology back-ends that prop up their businesses. In the interim period, Citi will provide services to ensure normal business operation and a seamless transition. Axis Bank will be paying Rs 1,500 crore for this service.

Observers said the most attractive part of the transaction is that Axis Bank will be able to plug into Citi’s affluent credit card customers who account for the highest monthly spends across the banking industry.

Citi had over 25 lakh credit cards outstanding at the end of February compared with 86 lakh for the private sector lender.

The acquisition of Citi’s credit card business will increase Axis Bank’s card base by 31 per cent and its market share of credit card spend is expected to go up by around 480 basis points.

The acquisition will thus bring Axis Bank’s credit portfolio closer to ICICI Bank which has issued over 1.27 crore credit cards. Axis Bank will thus be the country’s fourth largest credit card issuer in terms of absolute numbers of cards outstanding.

However, at a press conference on Wednesday, its senior management said the bank would become the third largest in terms of the book size. According to Axis Bank, the annual spend per card will rise by 17 per cent to Rs 119,000 from Rs 102,000 currently.

Chaudhry was pretty confident that Axis Bank would be able to retain Citi India’s customer base – a legitimate concern amid anecdotal evidence that Citi India has seen customer attrition over the past few months.

Chaudhry on this count was banking on Axis Bank’s wider product portfolio and bigger reach. Axis Bank added that Citi customers would continue to get all the rewards, privileges and offers to which they were previously entitled.

Axis Bank will also get access to around Rs 50,200 crore of deposits of which 81 per cent are low-cost current and saving accounts which it said also comprises best-in-class salary account customers. The combined CASA ratio is expected to improve by 200 basis points to 47 per cent.

A consumer lending portfolio of around Rs 18,500 crore consisting of mortgages, asset backed finance, small business lending and personal loans will also come within the Axis fold.

In its wealth management franchise, Axis Bank has assets under management (AUM) of over Rs 2.67 lakh crore. With the acquisition of Citi’s affluent clientele, this is expected to jump by 42 per cent, making it the third largest wealth manager in the country.