ATM operators are expecting to deploy more terminals with the Reserve Bank of India hiking a charge on their usage.

From August, the interchange fees, which are the amounts paid by a card issuing bank to the bank owing the ATM, have been raised to Rs 17 per financial transaction from Rs 15 in case of cash withdrawal and to Rs 6 from Rs 5 for non-financial transactions.

An RBI report said new ATMs were not keeping pace with the rise in the number of debit cards issued by PSU banks. The number of debit cards rose to 4,171 per ATM in March 2019 from 2,908 in March 2012. But the ATMs per 1 lakh debit cards have fallen to 24 from 34 .

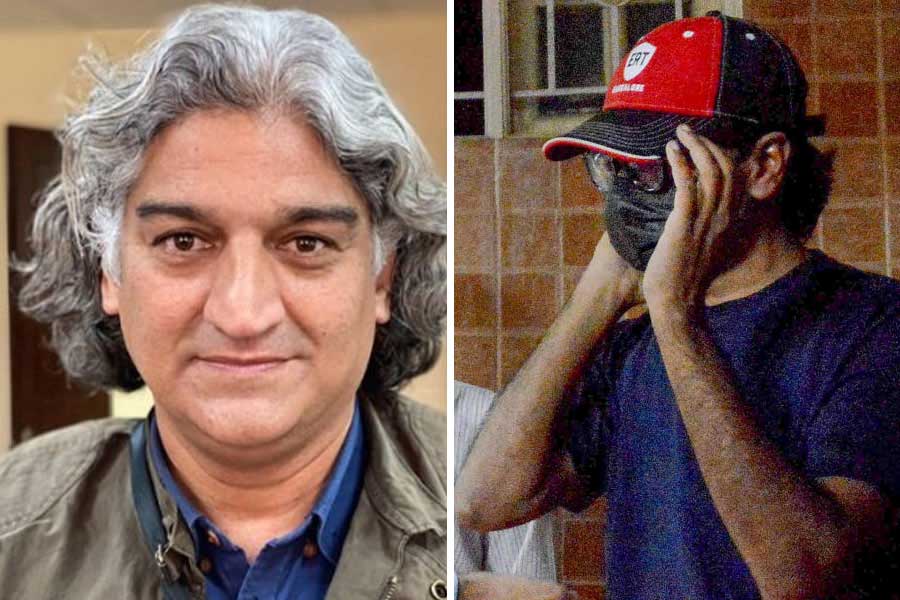

“In our judgement, a reason why banks and WLA operators (white label ATMs) were not putting in ATMs were because the economics of running ATMs were not making commercial sense. Cost of running an ATM will not change. But an increase in interchange fees have effectively brought down the transaction break even,” said K. Srinivas, MD and CEO, BTI Payments Pvt Ltd. He said the rise in the charges would encourage the deployment of more ATMs. Moreover, white label atm (WLA) licences available are on tap which may encourage more participation.

BTI will consider expanding its network from around 8,500 sites to cross 10,000 in the coming months, Srinivas said.

“Economic viability has an important co-relation towards deployment of new ATMs especially with increased cost of compliance. In my opinion several banks would now consider their ATM deployment strategy and we can expect net positive deployment numbers,” said Pranay Jhaveri, country manager – India and South Asia, Euronet Worldwide.

“Currency in circulation has grown significantly post demonetisation. The government is also executing direct benefit transfer into bank accounts of citizens. All these factors have led to an increased usage of ATMs. The increase in interchange fees will give a new filip to ATM deployment in semi urban and unbanked areas which will enable citizens to access cash from their bank accounts,” Jhaveri added.