One of the key factors helping an investor to create long-term wealth is asset allocation. Based on the principle of diversification, asset allocation helps to limit the risks and reduce the volatility in returns. An effective asset allocation can be considered as one where appropriate allocation to the right asset class is made at the right time. This is because in a market cycle, at different points in time, different asset classes may tend to perform well.

Key to investment

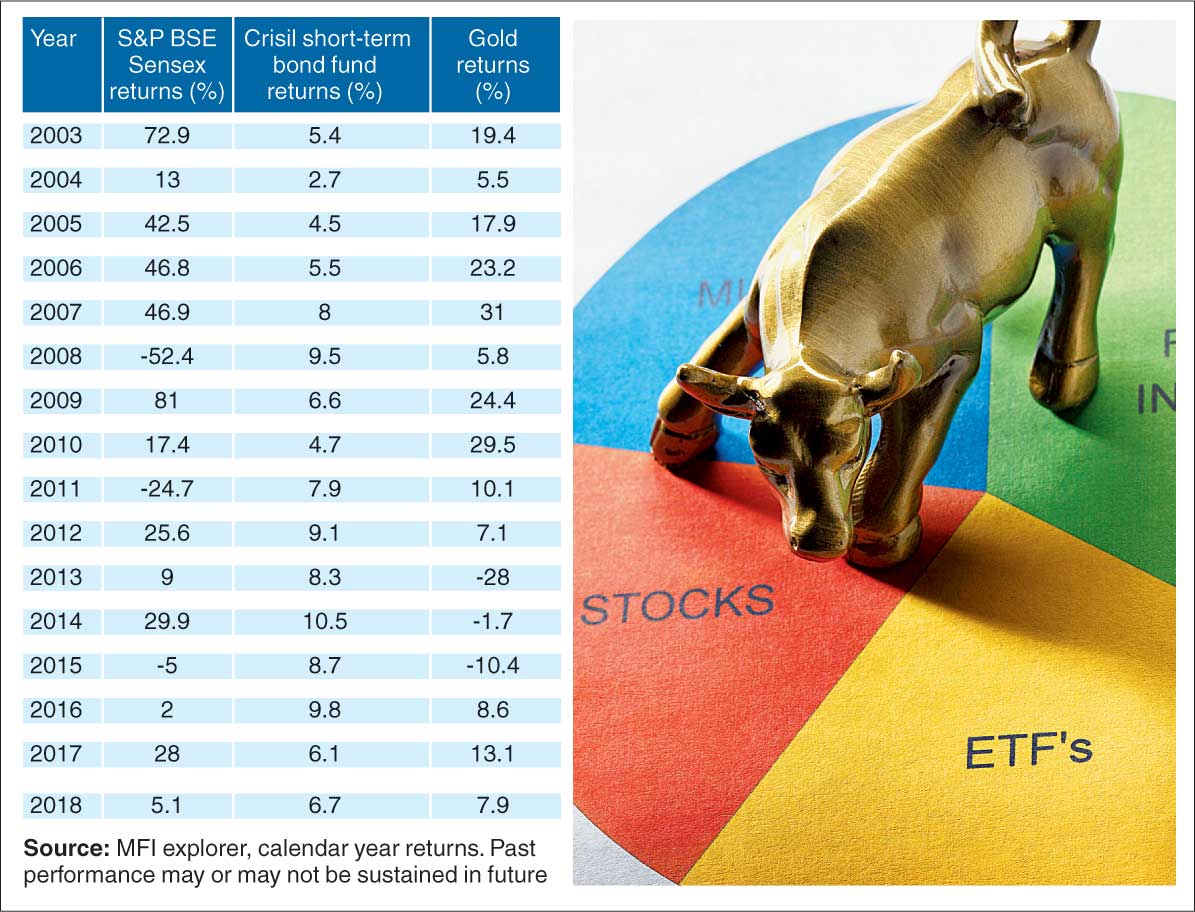

If you look at the historical data of various asset classes in terms of the returns generated, you will realise that the winners (asset classes) kept on rotating over the years. This is because the asset classes perform based on the market cycle, which is different for each segment (see chart).

For example, the equity market tends to perform well in expansionary economies. On the other hand, G-secs generally perform well in contracting economies. So, a rejig of allocation among the asset classes holds the key to a smooth investment journey.

Allocation in the right asset class is a key determinant for portfolio performance over the long run.

Research has shown that 91.5 per cent of the times asset allocation is the key determinant for portfolio performance followed by securities selection which came in at 4.6 per cent.

A typical pattern

Be fearful when others are greedy and be greedy when others are fearful is an often-heard saying attributed to legendary market investor Warren

Buffet. When it comes to asset allocation, especially in the case of equity investments, buy low and sell high is the way to go.

Even though this solution may look simple, when it comes to implementation investors frequently end up doing the opposite.

In reality, investors have a tough time keeping emotional biases at bay. This is after knowing that exceptional gains can be made only from investing against the tide rather than with it.

In the case of debt, investors tend to opt for traditional options which one is comfortable investing in, irrespective of which way the interest rates are headed.

And when it comes to the yellow metal, the investment pattern tends to be random in nature, mainly driven by the emotional value attached to the purchases made, especially in the form of jewellery.

Given this approach, the allocation tends to be static in nature, with re-balancing being an activity which is done as an afterthought rather than being a proactive one.

In such an investment approach, an investor tends to lose out on the changing attractiveness of an asset class, which an asset allocator fund can provide to the investors.

Fund focus

What this category of fund does is that it captures optimum allocation of various asset classes (debt/equity/gold) based on the attractiveness of one asset class over the other.

Here, the fund manager positions the portfolio in a manner which can make the most of the market cycle playing out at any point of time.

In effect, the fund manager helps an investor to be invested in the right asset class at the right time, thereby helping to generate long-term wealth.

In such category of funds, before reaching an investment decision, the fund manager would take into consideration the market valuations of both equity and debt independently because the right allocation not only depends on equity valuation, but also considers the opportunities that are available in the debt market.

Further, for allocation between the asset classes, sometimes in-house valuation model are taken into consideration.

In effect, the working of this fund ensures that the portfolio is rebalanced according to the attractiveness of the asset classes under consideration. For an investor, such a category of fund comes in handy, given that one needn’t be clued into market developments in order to switch between asset classes.

Moreover, it saves one from the operational hassles, taxation and probable exit load that an investment may face owing to switching investments across funds.

To sum up, an investor should consider this fund to be part of the portfolio, especially in the case of lumpsum investments as its active asset allocation offers diversification among various categories.

The writer is MD & CEO, ICICI Prudential AMC