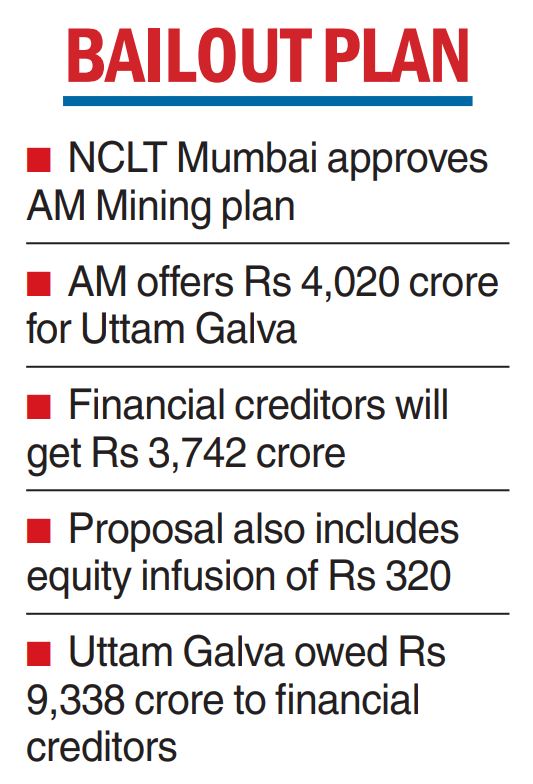

A Mumbai bench of the National Company Law Tribunal approved a Rs 4,020- crore plan of AM Mining Private Ltd, an affiliate of ArcelorMittal, on Thursday. Financial creditors of the company will get Rs 3,472 crore according to the plan which also includes an equity infusion of Rs 320 crore.

State Bank of India had taken the Maharashtra-based cold rolled downstream steel producer to bankruptcy court in 2020 due to a default on loan payment. UGSL owed Rs 9,338 crore to the financial creditors, which predominantly include the two affiliates of ArcelorMittal.

UGSL was chosen as the stepping stone by Lakshmi Niwas Mittal-led ArcelorMittal (AM) in 2009 after the steel tycoon’s many attempts to enter the Indian market failed. AM then took a 32 per cent stake in the company and came in as a co-promoter of the Miglani family.

The promoter tag became a burden in 2018 when it was found that UGSL is in default in a loan payment. To avoid disqualification under the newly inserted section 29A of the Insolvency & Bankruptcy Code, the Mittals sold their shares in UGSL before submitting a bid for Essar Steel, which was undergoing a corporate insolvency resolution process (CIRP).

However, the share sale did not salvage the day for AM who was still found ineligible under Section 29A which disqualifies a related party of a non performing assets (NPA) from being an eligible resolution applicant under CIRP.

The apex court invoked its special power under Article 142 of the Constitution, allowing AM a chance to pay the overdue amount to the creditors of UGSL and become an eligible resolution applicant for Essar Steel. Accordingly, two AM affiliates paid out Rs 7,921 crore to UGSL’s creditors and became eligible for Essar Steel, which it eventually acquired for another Rs 42,000 crore allowing Mittals to firmly set foot in India.

UGSL owes did not end: in 2020, SBI took the company to NCLT. Although six companies had initially submitted expressions of interest, including Sajjan Jindal’s JSW and Naveen Jindal’s JSPL, the only resolution plan came from AM Mining Pvt Ltd.