Shortfalls are also expected as the government will most probably miss divestment and spectrum sale targets. However, the finance ministry has maintained that the Centre will be able to meet its fiscal deficit target of 3.3 per cent of the GDP.

The RBI’s interim dividend, thus, is key to the government. “The bonus that the RBI could give if its capital reserves are lowered is not needed to balance the books. This could, however, be used for bank recapitalisation or a major welfare measure,” said officials.

The Jalan committee may also look into assertions made by experts that if the capital is revalued and a bonus is paid to the government, the RBI Act will then have to be amended, sources said.

The amendment will be an easy task for the ruling coalition given its strength in the Lok Sabha. Moreover, such an amendment will be a money bill and can merely be delayed by the Rajya Sabha and not held back. “However, if an amendment has to be brought in after the elections are announced, it will be debatable over its propriety,” said officials.

The finance ministry has been nudging the RBI to “recalibrate” its capital requirements — a polite way of saying that it should draw down its reserves and give a bonus dividend to the government.

The RBI’s capital reserves have gone up to Rs 9.59 lakh crore on account of the revaluation of its forex and bullion reserves because of a fall in the value of the rupee over the last few years.

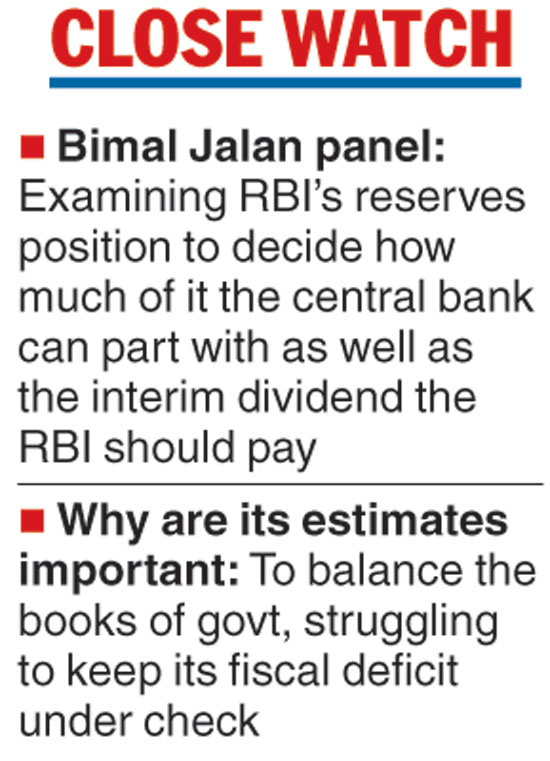

The Bimal Jalan- committee, which is examining the RBI’s reserves position to decide on the amount it requires, is likely to submit its report in April.

The committee, which was set up after a tussle over the government’s demands that the RBI part with a portion of its reserves, met for the first time on Tuesday to decide on an appropriate size of reserves that the central bank should maintain as well as the interim dividend that the RBI should pay.

Sources said the committee indicated that a report on the ideal reserves position of the RBI could only be ready by April.

However, finance ministry officials said the RBI was likely to pay a dividend of up to Rs 40,000 crore before the financial year was over as this was a separate issue.

The government’s books are likely to be in the red this financial year given the low collections from the GST, where a shortfall of about Rs 1 lakh crore is likely by the end of the financial year.

The Telegraph