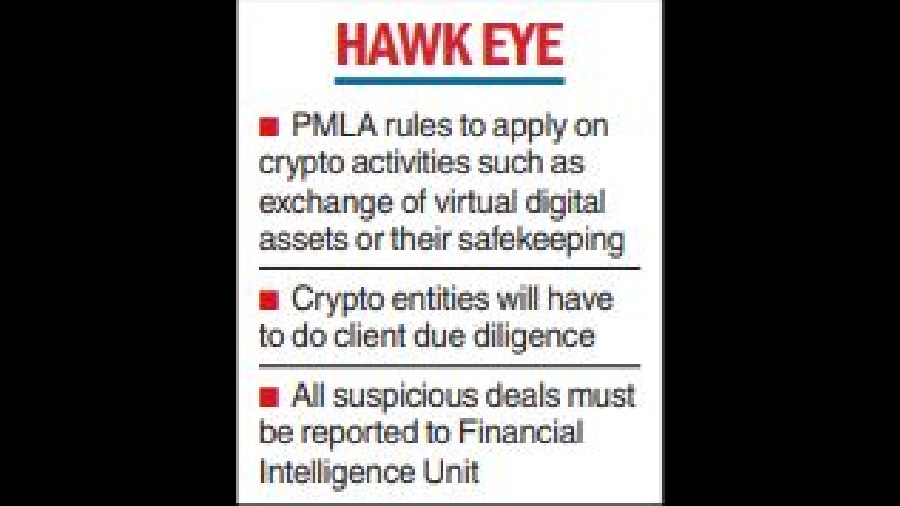

The government has imposed anti-money laundering provisions on cryptocurrencies or virtual assets.

In a gazette notification, the finance ministry said the anti-money laundering legislation has been applied to crypto trading, safekeeping and related financial services.

Indian crypto exchanges will have to report suspicious activity to the Financial Intelligence Unit India (FIU-IND).

The move is in line with the global trend of requiring digital-asset platforms to follow anti-money laundering standards similar to those followed by banks or stock brokers.

The notification said, “Exchange between virtual digital assets and fiat currencies, exchange between one or more forms of virtual digital assets, transfer of virtual digital assets, safekeeping or administration of virtual digital assets or instruments enabling control over virtual digital assets, and participation in and provision of financial services related to an issuer’s offer and sale of a virtual digital asset will be now be covered by Prevention of Money-laundering Act, 2002.”

Virtual digital assets were defined as any code or number or token generated through cryptographic means with the promise or representation of having inherent value.

Sharat Chandra, co-founder India Blockchain Forum, said: “It mandates entities dealing in crypto to follow KYC, anti-money laundering regulations and due diligence as followed by banking and other financial entities which fall under the classification of reporting entities under PMLA,” he said.