Two of Anil Agarwal’s India-listed companies on Friday announced big plans to spin off their businesses.

Vedanta Ltd, the metals-to-mining conglomerate, is undertaking an extensive demerger to unlock value that will see it split into six listed firms.

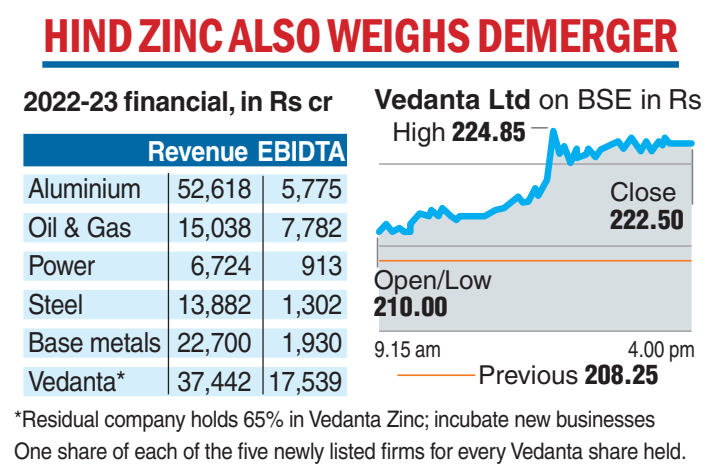

The businesses that will be demerged include aluminium, oil and gas, power, steel and ferrous materials and base metals.

Shareholders of the company will get one share of each of the five newly listed companies for every share held in Vedanta.

Separately, Hindustan Zinc Ltd in a statement said it could create separate legal entities for its zinc and lead, silver, and recycling businesses to help capitalise on “distinct market positions” and attract investors.

A committee of directors will evaluate the options and advise the board, along with external advisers.

Vedanta Ltd will continue to hold 65 per cent of Hindustan Zinc Ltd. and the new businesses of stainless steel and semiconductor/display.

Its parent, London-based Vedanta Resources will continue to be the holding company of a diversified mining group.

More than 90 per cent of Vedanta Ltd’s profits are from Indian operations.

Vedanta expects to receive NOCs (no objection certificates) from the stock exchanges after Sebi approval by October 2023. It expects the listing and trading of the new companies by September 2024.

"By demerging our business units, we believe that will unlock value and potential for faster growth in each vertical. While they all come under the larger umbrella of natural resources, each has its own market, demand and supply trends, and potential to deploy technology to raise productivity,’’ Anil Agarwal, chairman of Vedanta, said.

The aluminium business will be led by John Slaven, formerly of Alcoa and BHP. Steve Moore will be the deputy CEO of Vedanta Oil and Gas which posted consolidated revenues of over Rs 15,000 crore in 2022-23.

Vedanta Power will be run by Vibhav Agarwal, currently CEO of Talwandi Sabo Power Ltd, a wholly-owned subsidiary of Vedanta Ltd.

The business will include the 600MW Jharsugada power plant, the recently acquired 1200MW Athena plant and the 1000MW Meenakshi plant which is in the process of being acquired.

Vedanta Steel and Ferrous materials will include Vedanta’s iron ore business.

The business has aspirations to more than double annual iron ore production, from assets in India and Liberia to 13 million tonnes (mt) by 2025.

In base metals, Vedanta said it will contain a mix of strong international base metal production assets, growth projects and downstream businesses.

High rates

Vedanta has raised Rs 2,500 crore through the sale of bonds maturing in 18 months at sharply higher rates, three merchant bankers said on Friday.

The company will offer a coupon of 12 per cent, payable every quarter to investors of the issue, which is unrated, bankers said.