The Telegraph

Conditions apply

Prabhu added that start-ups are eligible for exemption under Section 56(2)(viib) if it is a private limited company recognised by the DPIIT and not investing in certain categories of assets.

Those assets include investments in real estate; loans and advances; capital contribution made to any other entity; buying shares and securities; a motor vehicle, aircraft, yacht or any other mode of transport exceeding Rs 10 lakh; and jewellery. However, the exclusions would not cover those startups who are in that particular sector and holding the specified products as stock in trade.

Elaborating on the exemptions, DPIIT secretary Ramesh Abhishek said angel investors who were investing less than Rs 5 crore were getting taxed and “by exempting investments up to Rs 25 crore, any investments from any investor, we have gone far beyond the angel investment issue”.

The relaxation will help a large number of startups, he said adding earlier mainly bio-tech startups used to avail themselves the benefit.

Further, there is no requirement of making any application for exemption under this section and there will be no case-to-case examination of start-ups for exemption.

“Angel tax had begun to dampen the enthusiasm of investors and start-ups. Today’s announcement will unleash the next wave of entrepreneurship, moving India from the third place to the number one start-up nation in the world,” Saurabh Srivastava, chairman of the Indian Angel Network (IAN), said.

Rakesh Nangia, managing partner, Nangia Advisors, said: “Exemption granted to large listed companies will encourage start-ups seek funding from such listed companies. Further, by excluding the investments received from non-residents from overall investment limit will encourage the start-ups to seek funding from non-resident investors, without any limit and ensuring that only investments from resident investors is subject to overall investment limit.”

“The changes will unshackle angel investing and bring in domestic monies for start-up,” Padmaja Ruparel, co-founder of the IAN, said.

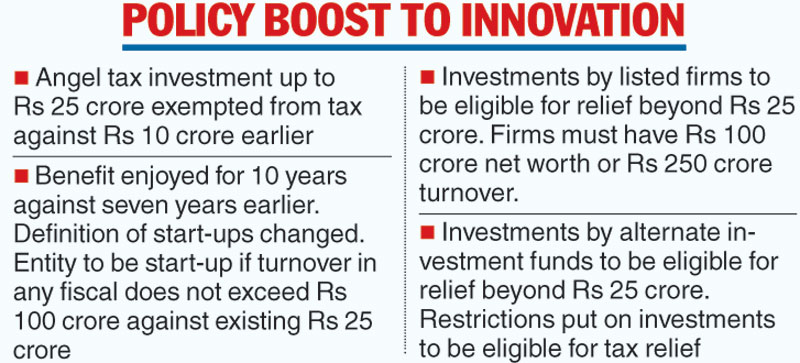

The government on Tuesday allowed full tax relief on angel investments in start-ups up to Rs 25 crore and permitted them to enjoy the benefit of the concessions for a period of 10 years, giving a much needed relief to budding entrepreneurs at the receiving end of tax notices on their angel investments.

At present, concessions are available for angel investments up to Rs 10 crore and for a period up to seven years.

“Today we have issued a notification which will bring in a lot of welcome changes. It is a great movement forward. Start-ups are innovators and job creators and we would like to support it fully. Taxation issues cropped up. We took up the issues with the line ministries,” commerce and industry minister Suresh Prabhu told reporters here.

Besides, tax concessions will be available on investments by corporate entities in the start-ups.

The definition of start-ups has been changed to enable them to enjoy the benefits for 10 years. An entity will be considered as a start-up for 10 years since its incorporation or registration date.

Besides, “an entity shall be considered as a start-up if its turnover for any of the financial year, since its incorporation or registration, has not exceeded Rs 100 crore instead of the existing Rs 25 crore”, Prabhu said.

Also, investments by listed companies with a net worth of Rs 100 crore, or a turnover of Rs 250 crore, into an eligible start-up would be exempted from Section 56(2)(viib) of Income Tax Act, 1961, beyond the Rs 25-crore limit.

In order to enjoy the exemption, a start-up will be required to submit a self-declaration about the use of the amount raised to the DPIIT (Department for Promotion of Industry and Internal Trade), which will be forwarded to the Central Board of Direct Taxes (CBDT).

“Start-ups shall file a duly signed declaration to the DPIIT for availing exemption because it will ensure that legitimate entities get this,” Prabhu said.

With regard to the tax demands raised by the CBDT, the board said the field formations have been advised to expeditiously clear the cases. Several start-ups had claimed that they had received angel tax notices. Many had raised concerns on notices sent to them under Section 56(2)(viib), to pay taxes on angel funds received by them.

S. Vasudevan, partner, Lakshmikumaran & Sridharan Attorneys, said “the stated exemptions may provide much needed relief to the relatively larger sized start-ups, having turnover up to Rs 100 crore, who may have been required to pay tax on premiums received on share subscription”.

It was also clarified that investments made by friends, or family members or promoters will be exempted up to Rs 25 crore.

The minister said the Rs 25-crore limit will not include “the amount that is coming from alternate investment funds or eligible listed firms. So even if you are Rs 25 crore plus, you continue to enjoy the benefit”.