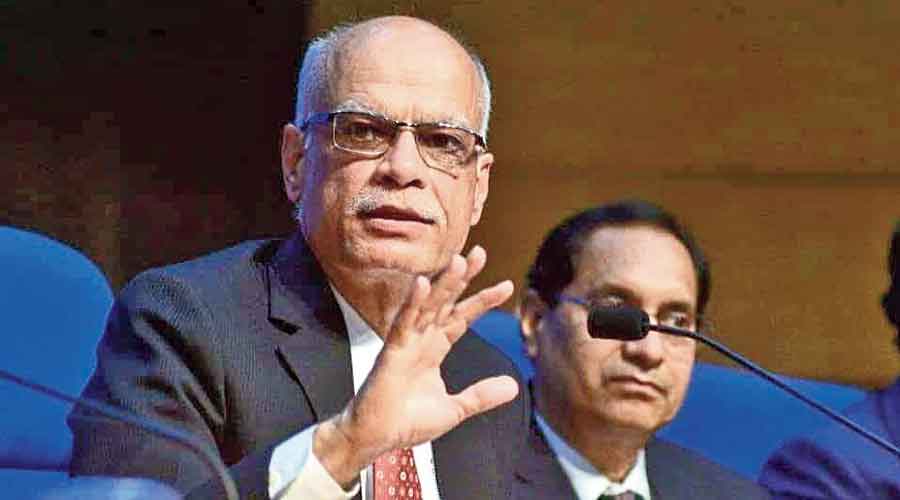

The alternative income tax structure without the benefit of exemption may be reviewed with revenue secretary Tarun Bajaj on Friday pointing out it has not been “well laid out”.

The alternative regime was introduced in 2020 under section 115BAC of the Income Tax Act and offered six rates — 5, 10, 15, 20, 25 and 30 per cent — against three in the tax regime with exemptions.

While taxpayers can opt for either the existing or the alternative structure, the lack of exemptions such as house rent, leave travel allowance, home loan interest and benefits under section 80C and 80D of the Income Tax Act in the new regime has not evoked much interest among taxpayers.

“I think that is somewhat not very well laid out because till about Rs 8-9 lakh of income, it makes no reason for anybody to move to the new tax regime because in the older tax regime with exemption, there is no tax.”

“But in the new regime, tax has to be paid immediately after Rs 2.5 lakh of income,” Bajaj said at a Bengal Chamber of Commerce event here on Friday.

Since the new regime is a work in process the tax authorities are analysing the available data to get it right in the future, Bajaj said.

Focus on TDS

He said the government is increasingly trying to deduct tax at source with TDS comprising around 55 per cent of the collections.

“We are now trying to catch taxes while transactions are taking place rather than only based on income returns that are coming. That also ensures that revenue gets the taxes on a monthly basis,” said Bajaj.

He said 11 crore people in the country pay taxes through the TDS route but only 7 crore file returns.

He said that based on the revenue growth trends, the fiscal deficit may go down by 0.1 to 0.2 per cent over revised estimates.

In the budget, the government has set a revised fiscal deficit estimate of 6.9 per cent of GDP in 2021-22 and a budget estimate of 6.4 per cent of GDP in 2022-23.

“We had the opportunity to make it much less. But we have increased our capital expenditure to Rs 7.5 lakh crore from about Rs 5.5 lakh crore,” Bajaj said, adding the government has realised that whenever there is a constraint on finances, capital expenditure is the first casualty.