Allahabad Bank MD and CEO CH. S. S. Mallikarjuna Rao said the slippages have increased on account of the NPAs in the IL&FS accounts as well as the farm loan waiver announced in some states. There was also slippage in the MSME segment.

“The IL&FS exposure (of the bank) stands at around Rs 1,245 crore, comprising 12-13 accounts. Of these, around 3 accounts where the outstanding was Rs 300 crore have already been identified as NPA as there was no recovery. For the remaining accounts with around Rs 900 crore are SPVs where the cash flow is generated regularly, there is no overdue. We do not foresee any further immediate strain,” said Rao.

The net NPA ratio has come down to 7.70 per cent during the quarter against 8.97 per cent a year ago. Resolution of cases referred to the NCLT coupled and proactive recovery will help to further trim the net NPA ratio.

The Telegraph

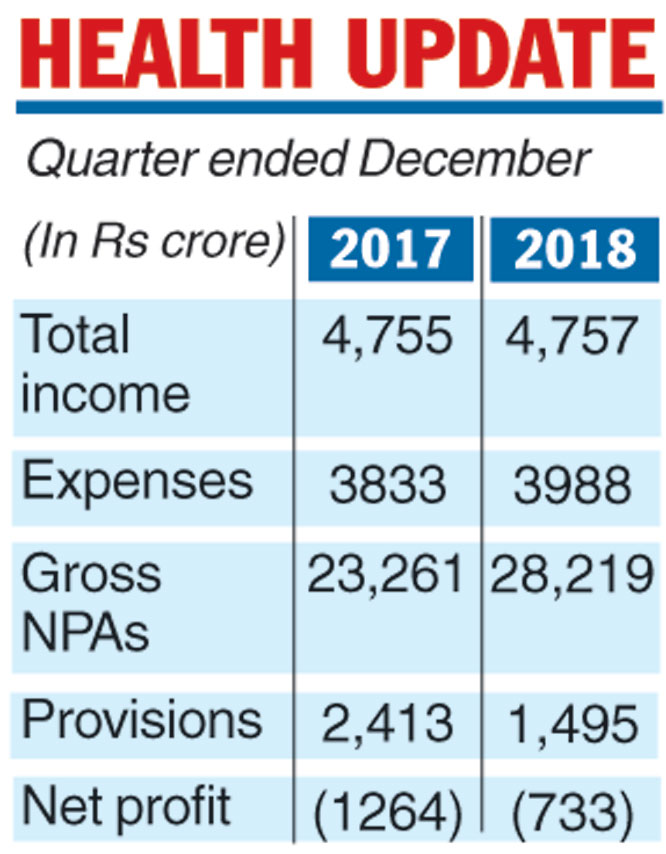

Allahabad Bank has trimmed its losses to Rs 732.81 crore for the quarter ended December 31, 2018 from Rs 1,263.79 crore in the corresponding period of the previous year.

While a write-back of mark-to-market provisions had a favourable effect on the bottomline, the bank has seen a deterioration in its asset quality with fresh slippages going up during the quarter on account of the IL&FS default.

Gross NPA was 17.81 per cent during the October-December quarter, higher than 14.38 per cent a year ago. The bank has seen fresh slippages of Rs 2,540 crore.