The Calcutta-based Allahabad Bank and two other lenders have come out of the Reserve Bank’s prompt corrective action (PCA) framework.

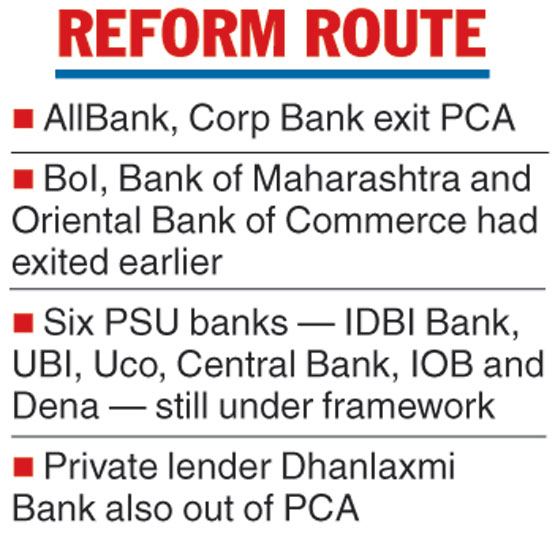

Other than Allahabad Bank, the Reserve Bank of India (RBI) on Tuesday removed public sector Corporation Bank and private sector lender Dhanlaxmi Bank from the PCA list.

Earlier the RBI had taken three other state-owned lenders — Bank of India, Bank of Maharashtra and Oriental Bank of Commerce — out of the PCA mechanism.

The decision to release the two PSU lenders — Allahabad and Corporation Bank — from the PCA mechanism was expected after the recent capital infusion by the government. While the Centre had put in Rs 48,239 crore in 12 PSU banks, Corporation Bank was the biggest beneficiary as it got Rs 9,086 crore, followed by Allahabad Bank with Rs 6,896 crore.

The RBI had put in a revised PCA structure in April 2017 under which banks’ performance was determined on the basis of three criteria — capital-to-risk weighted assets ratio, asset quality (net NPAs) and profitability (return on assets).

There were three risk thresholds and the breach of any one resulted in the invocation of the PCA, following which various curbs, including that on lending, were placed on the lenders.

Of the 21 PSU banks, 11 were under this mechanism. The sole private sector lender under the PCA was Dhanlaxmi Bank.

Following the cash infusion, Allahabad Bank had said it would use Rs 2,750 crore to make loan loss provisions so as to bring down the net NPA ratio below the threshold of 6 per cent. It used the residual amount to shore up the capital base to enhance the capital-to-risk weight asset ratio above the minimum threshold of 10.875 per cent.

Similarly, Corporation Bank had used the capital infusion to make loan loss provisions to bring the net NPA below the threshold required under the PCA.

The RBI said in a statement that its Board of Financial Supervision (BFS) met on Tuesday to review the performance of the banks under the PCA.

Taking note of the infusion, the BFS pointed out that it had resulted in better capital funds and loan loss provisions for the banks to ensure that the PCA parameters were complied with.

“The banks also apprised the RBI of the structural and systemic improvements put in place to maintain these numbers.

“Accordingly, based on the principles adopted by the BFS in its earlier meeting dated January 31, it was decided that Allahabad Bank and Corporation Bank be taken out of the PCA framework, subject to certain conditions and continuous monitoring,” the RBI said.

Dhanlaxmi Bank has also been taken out of the PCA framework, subject to certain conditions and continuous monitoring, as the lender has not breached any of the risk thresholds of the mechanism.

The RBI said it will continuously monitor the performance of these banks under various parameters.

However, six PSU banks — IDBI Bank, United Bank of India, Uco Bank, Central Bank of India, Indian Overseas Bank and Dena Bank — are still under the PCA framework.

With Dena Bank set to merge with the Bank of Baroda (BoB), the list will come down to five at the beginning of the next financial year.

The Telegraph