Shares of One97 Communications, tanked at the stock exchanges on Thursday, on reports of Chinese conglomerate Alibaba selling nearly half of its stake — 3.1 per cent — in the parent company of Paytm.

Alibaba held 4.06 crore shares comprising 6.26 per cent of the equity of Paytm at the end of the second quarter (September) of this fiscal.

However, Alibaba group firm Ant Financial Holdings — which holds 16.14 crore shares or 24.88 per cent in Paytm — did not dilute its stake in the company on Thursday.

Sources said a block deal took place in the Paytm stock on Thursday with 1.92 crore shares sold at Rs 536.95 per share totalling around Rs 1031 crore.

It is learnt that the shares were sold by Alibaba. The Chinese group has also sold part of its stake in other aggregators such as BigBasket and Zomato as it could be making an exit from India.

Paytm’s shares have been gaining after its associate Paytm Payments Bank received RBI approval to appoint Surinder Chawla as its managing director and CEO.

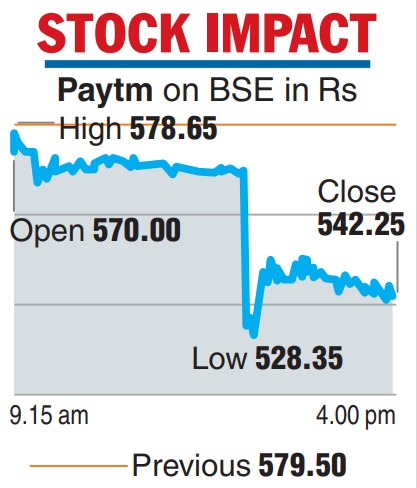

Shares of Paytm on Thursday ended at Rs 542.25 on the BSE, a fall of Rs 37.25 or 6.43 per cent over its last close. During intra-day trades, it crashed to Rs 528.35 — a loss of nearly 9 per cent. Around 28.96 lakh shares were transacted on the bourse compared with the two-week average of 1.31 lakh shares.

On the NSE, the counter ended at Rs 543.50, a fall of 6.16 per cent. Around 3.55 crore shares were transacted.

Paytm which has been in the news for giving negative returns to its investors post listing has seen some gains in recent times amid its ongoing buyback programme. The board of One97 Communications had on December 13, 2022, announced a share repurchase of up to Rs 850 crore.

While the buyback disappointed the Street, developments such as the appointment of Chawla supported the stock.