The loan repaying capacity of industries indirectly using fossil fuels may become sensitive to the green energy transition and their impact on the overall banking system needs to be monitored closely, an article in the Reserve Bank of India’s (RBI) monthly bulletin has said.

According to the article in the RBI’s March bulletin, the transition to a net-zero carbon emission target will lead to adjustments in the production processes of industries that are directly or indirectly exposed to excessive use of fossil fuel.

Therefore, there can be spillover effect on domestic banks due to their exposure to these industries.

The article added that the three sectors with direct exposure to fossil fuels are electricity, chemicals, and automobiles. They account for around 24 per cent of credit to overall industrial sector, but only 10 per cent of total outstanding non-retail bank credit.

While this could imply a limited spillover to the banking system, there are various other industries, that indirectly use fossil fuels. In these cases, the transition to green energy can have implications for their income and consequently their interest coverage ratio (ICR). As a result, the gross non-performing assets (GNPA) ratio of these industries may be sensitive to green energy transition, the article noted.

Using the Annual Survey of Industries (ASI) data for 2016-17 to compute the fossil fuel intensity for each sector, the article said that cement products and basic metals are the two most exposed sectors to fossil fuel since 29 per cent and 14 per cent of total inputs, respectively, are sourced from fossil fuel.

However, the cement industry has seen several technological advancement in production process in recent years which has reduced its fossil fuel intensity considerably

As regards the indirect exposure of various industries to fossil fuel and its impact on bank credit as the world goes green, the article said that almost all segments in the economy are indirectly exposed to fossil fuel by virtue of using electricity, petrol or diesel, coal in their production processes.

In India, 62.2 per cent of the total electricity generated is sourced from fossil fuel and the rest from renewable or non-fossil sources.

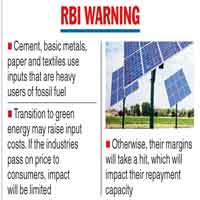

However, the sectors which have high input intensities of fossil fuel through indirect exposure are cement, basic metals, paper products, and textiles.

“Because of a transition to green energy and shifts in input mix, there could be some pressure on input costs in these sectors in the short-term. Depending on the market structures and pricing-power, this increase in cost could be transferred to the end-users or could be borne by the firms.”

“In the second scenario, the EBITA (earnings before interest, tax and amortisation) of the representative firm could take a hit leading to worsening of loan serviceability. This, in turn, could lead to an increase in GNPA (gross non performing assets) ratio of such sectors,’’ the article cautioned.

The focus on green energy has come after the landmark Paris Agreement which is a legally binding international treaty on climate change. The agreement was adopted by 196 parties in December 2015 and has come into effect since November 2016.

The goal of the deal is to limit global temperature rise to below 2 degrees celsius, preferably to 1.5 degrees Celsius.

While various countries have committed themselves to bring down their green house gas (GHG) emission, in India several conglomerates ranging from the Reliance to Adanis and the Tatas have announced initiatives in the green energy segment.