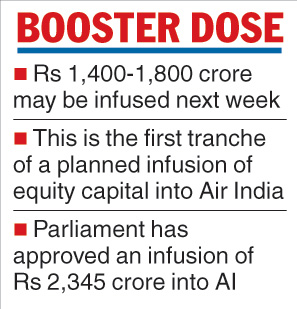

The government is likely to infuse Rs 1,400-1,800 crore as the first tranche of a planned infusion of equity capital into ailing national carrier Air India next week.

The government had last year received Parliament’s approval to infuse Rs 2,345 crore of equity into Air India.

In a report, the Swadeshi Jagran Manch (SJM), a right-wing think-tank affiliated to the RSS, had recommended writing off the entire debt.

The capital infusion is part of a larger revival plan. The airline has been extremely cash strapped and has problems in paying equipment suppliers for spares.

Besides raising money by selling subsidiaries and non-core assets, the government plans to transfer about half of its Rs 55,000-crore debt as well as non-core assets into another company as part of the restructuring plan.

The airline is also starting a number of new flights and attempts are being made to increase plane load factors to make existing operations more profitable.

Air India’s woes stem from a huge debt overhang from the purchase of 111 aircraft and giving away of slots and flying rights. A downturn in the travel market post 2008 on the back of a spike in oil prices made things worse for the airline. Besides, a badly managed merger of loss-laden Air India with profitable Indian Airlines played a major role.

The domestic market share of the airline has shrunk from more than 13 per cent in the beginning of 2018 to just over 12 per cent. In the same period, IndiGo stepped up its share from 39.7 per cent to 43.2 per cent.

The Telegraph