The agreement to raise the US debt ceiling generated a wave of optimism across world markets that swept over Indian stocks with the benchmark indices inching towards their lifetime peaks.

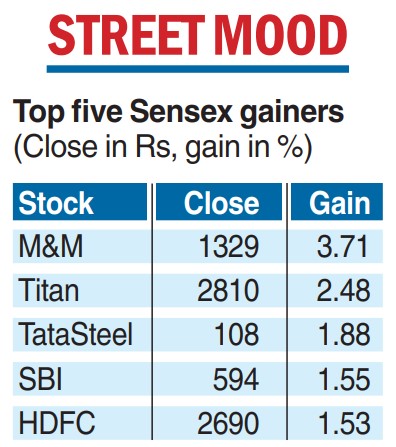

The Sensex on Monday reclaimed the 63000-level but later ceded ground to close at 62846.38 a gain of 344.69 points or 0.55 points as foreign portfolio investors (FPIs) enlarged their bets in the wake of the debt deal.

The broader NSE Nifty gained 99.30 points or 0.54 per cent to end at 18598.65.

In three days of gains, Sensex rose 1072 points or 1.8 per cent while the Nifty spurted 313 points or 2 per cent thatled to India overtaking France to reclaim its position as the world’s fifth largest market by market capitalisation, Bloomberg reported today.

While foreign portfolio investors (FPIs) contributed to the rally, the rally in Adani group stocks also played its part,especially after the Supreme Court-appointed committee submitted its report.However, the conglomerates put in a mixed show on Monday with just five of the 10 listed stocks ending in the green.

At the close, the combined market capitalisation on the BSE stood at Rs 283.8 trillion or $3.43 trillion against France’s market capitalisation of $3.2 trillion as of Friday, Bloomberg data showed.

The 30-share BSE Sensex opened in the green at 62801.54 and rose 524.31 points or 0.83 per cent to 63026. However, it came off these highs to settle at 62846.38.

“The recent rally in the Indian markets has been largely influenced by the developments in Wall Street, particularly the raising of the debt ceiling in the United States. This has provided a confidence boost to investors and contributed to the positive sentiment in the market.

“The banking stocks have shown remarkable strength and have been key driversof the market’s upward trajectory.

“Additionally, the metals sector has also been performing well, showcasing positive momentum,’’ Prashanth Tapse, senior VP (research), Mehta Equities, said.

Tapse said a significant support level for the Nifty is seen at 18283.

“This level has proven to be crucial in sustaining the market’s upward momentum. With this support intact, it appears that the gates are now open for further upside potential in the market.’’

Re seen to reach 80-levels

Mumbai: The rupee is forecast to bounce back from close to its all-time low of 83.29 as the Reserve Bank of India (RBI) slows its dollar purchases.

A Bloomberg report quoting Aditya Bagree, head of markets for India and South Asia at Citigroup, said the domestic unit may rebound to 80 against the greenback because of moderating crude prices and rising services exports. “We are constructive on the rupee in the short term. There are almost 11 months of import cover, and hence from here, the RBI may slow the pace of accumulation,’’ he said.

The rupee on Monday closed at 82.63 to the dollar against the previous close of 82.57. Anindya Banerjee, VP — currency derivatives and interest rate derivatives — at Kotak Securities said the trading session was marked by low volumes amid the holiday in the UK and US markets. Over this week, the focus will be on the US jobs data and the rupee could remain range bound between 82.30 and 82.80 in the spot market.

The RBI's purchase of dollars is a major reason behind the rupee failing to rally against the greenback.