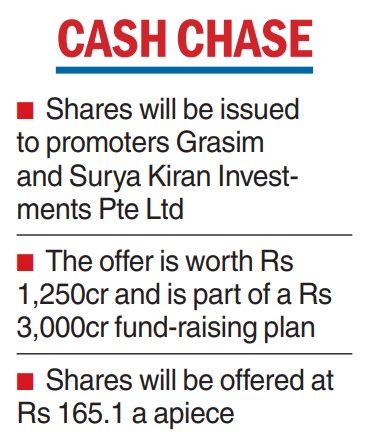

Aditya Birla Capital Ltd (ABCL) is raising Rs 1,250 crore through a preferential issue to promoter firms Grasim Industries and Surya Kiran Investments Pte Ltd. The offer is part of a plan to collect Rs 3,000 crore from the market, which was cleared by the company’s board on May 11.

“In a follow-up to this, today (Thursday), the company’s board of directors approved preferential issuance of Rs 1,250 crore to its promoter and promoter group entity, out of the total approved equity fund raise of up to Rs 3,000 crore. The preferential issuance will be undertaken at the price of Rs 165.1 per equity share… and is subject to shareholder approval,’’ a statement from the company said.

ABCL is the holding company for the financial services business of the Aditya Birla group.

It said Grasim will invest Rs 1,000 crore and Surya Kiran Investments Pte Ltd the rest.

The funds will be used for multiple purposes: to augment the capital base, improve the solvency margin and leverage ratio.

They will be used to meet the company’s growth requirements and make investments in one or more subsidiaries, associates or joint ventures engaged in certain businesses and technology.

ABCL will also upgrade its IT infrastructure and digital platforms with the money.

The company will seek the approval of the shareholders at an extraordinary general meeting on June 24.

Shares of ABCL on Thursday ended at Rs 171.70, a gain of Rs 1.55 or 0.91 per cent over the last close on the BSE. The promoters currently hold around 71.25 per cent of its equity: Grasim Industries holds 54.15 per cent, while the shareholding of Surya Kiran stands at 0.93 per cent.

As of March 31, 2023, ABCL managed aggregate assets under management of about Rs 3.6 lakh crore. During the fiscal year ended March 31, 2023, the company reported consolidated revenue of Rs 29,999 crore and a profit after tax of Rs 2,057 crore. It reported a 35 per cent increase in consolidated net profit to Rs 609 crore in the fourth quarter ended March 2023.

The company had earned a net profit of Rs 450 crore in the year-ago period. The company’s total income rose to Rs 8,052 crore against Rs 6,620 crore a year ago.

The operating profit increased to Rs 832 crore during the fourth quarter of 2022-23 from Rs 608 crore a year ago, it said. Its asset quality continued to improve, with gross stage 2 and 3 assets declining 114 basis points sequentially and 314 basis points year-on-year to 5.84 per cent as on March 31, 2023.