Adani Infrastructure & Developers has made an unsolicited and a non-binding offer to acquire Jaypee Infratech.

The Adanis are willing to infuse funds to speed up the construction of the stuck housing projects as well as settle the claims of financial creditors and workmen.

The bid was submitted to the interim resolution professional (IRP) of Jaypee Infratech on Tuesday.

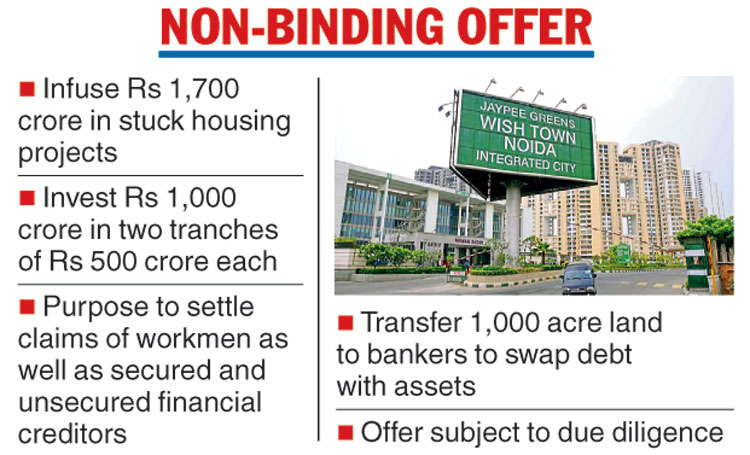

The Adanis have proposed to bring funds up to Rs 1,700 crore to finish the flats and another Rs 1,000 crore for the workmen and financial creditors.

They had participated in the first round of the insolvency process but did not submit any bid in the current round within deadline.

The IRP has circulated the non-binding bid made by the Adani group to the lenders.

However, a PTI report said the bid was not on the agenda of the meeting of the committee of creditors on Thursday, where the panel will take up NBCC’s bid.

The Adani group said in its offer that if the Supreme Court and the National Company Law Tribunal (NCLT) permit, the amount of Rs 750 crore deposited by Jaiprakash Associates for protection of home buyers could also be utilised to pay balance penalties or interest.

However, the Adanis said its proposals were subject to a due diligence of Jaypee. After the due diligence, it will specify the timelines for the delivery of possession as well as seek relief and waivers.

The Telegraph

In August 2017, Jaypee Infratech went into insolvency process after the NCLT admitted an application by an IDBI Bank-led consortium.

Responding to a clarification sought from the stock exchanges, Jaypee Infratech on Wednesday said that no negotiations had taken place with the Adani group subsequent to its bid.

Jaypee added that the corporate insolvency resolution process (CIRP), as directed by the Supreme Court, came to an end on May 6, 2019. The NCLT, Allahabad, in an application filed by IDBI Bank has directed the CoC and IRP must be allowed to proceed further with the CIRP process in accordance with law while adjourning the matter till July 29.

In the first round of insolvency proceedings, conducted last year, the Rs 7,350-crore bid of Lakshdeep, part of Suraksha Group, was rejected by the lenders.

Later in October 2018, the IRP started the second round of the bidding process on the NCLT’s direction. NBCC and Mumbai-based Suraksha Realty submitted their bids for Jaypee. Recently, the CoC rejected the bid of Suraksha Realty through a voting process. The panel then decided to put on vote NBCC's offer even as bankers were opposed to this move.

On the bankers’ plea, the National Company Law Appellate Tribunal had on May 17 annulled the voting by home buyers and lenders on NBCC’s bid and allowed renegotiation on the offer by May 30. The voting process on NBCC’s bid could start from May 31.

Meanwhile, the committee of creditors of Reliance Communications is scheduled to meet on Thursday, the company said in a regulatory note.

'...a meeting of committee of creditors will be held on May 30, 2019,' RCom said in the note on Wednesday.