Adani Ports and Special Economic Zone Ltd has announced a buyback of foreign currency bonds worth $130 million as the troubled conglomerate gamely pushes ahead with its effort to trim its gross debt that amounted to Rs 42,750 crore at the end of September last year.

The company has offered to pay cash to buy back its 3.375 per cent, Senior Notes that are due in 2024.

The outstanding principal amount on these Notes is $650 million.

The decision to purchase the Notes was taken at a meeting of the finance committee of the board which was held at 4 a.m. on Monday – and conveyed to the markets in Asia before they opened for trading.

The purpose of the tender offer “is to partly prepay the company’s near-term debt maturities and to convey (its) comfortable liquidity position”, Adani Ports said in a regulatory filing.

It intends to spend $130 million in each of the next four quarters to purchase these outstanding notes.

“The company may choose to accelerate or defer this plan subject to its liquidity position and the market conditions,” it said. The pricing will be announced separately for each of such tranches, it added.

Adani Ports said it would dip into its internal cash reserves to fund the bond purchase.

Some reports suggest that the group is also evaluating bond buyback opportunities at other entities and may soon finalise a capital allocation plan.

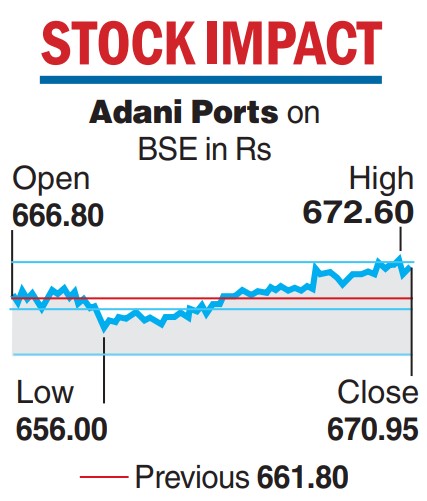

A Bloomberg report said the prices of 10 out of 15 dollar-denominated notes of Adani Group companies rose in Hong Kong on Monday morning. Adani Ports’ July 2024 3.375 per cent senior debt jumped 0.69 per cent, the biggest advance in a month.

The buyback would mark another effort by the group to regain investor confidence, including trimming capital spending, after a Hindenburg Research report pounded its bonds and shares.

Adani Ports has more than Rs 6,300 crore of liabilities due next year, its biggest maturity wall in the near term, according to data compiled by Bloomberg, with an even larger year for maturities coming in 2027.

First tranche set at $130m

The company is offering to pay $970 per $1000 principal amount of each Note if the holder tenders his holding by 5 p.m. New York time on May 8. After that deadline, the cash offer will fall to $ 955.

The holders will also receive accrued interest from the last interest payment date up to, but not including, the early settlement date which “is expected to be May 10, 2023, but is subject to change without notice”.

The maximum acceptance amount is $ 130 million, the company added. If the Notes tendered by the early tender date (May 8) exceed the sum, the company will not accept and further Notes tendered after that date.

The company said it reserves the right — in its sole and absolute discretion – to purchase the Notes in excess of or below the maximum acceptance amount, it said.

It also reserved the right to “extend, terminate or withdraw” the tender offer at any time, and amend it in anyrespect “without extending the withdrawal deadline” of May 8.

It has engaged Barclays Bank, DBS Bank Ltd, Emirates NBD Bank PJSC, First Abu Dhabi Bank PJSC, MUFG Securities Asia Ltd, Singapore branch, SMBC Nikko Securities (Hong Kong) Ltd and Standard Chartered Bank to serve as dealer managers for the tender offer.

It also named Morrow Sodali Ltd as information and tender agent.