Adani Ports and Special Economic Zone (APSEZ) has received bids up to $412.7 million in response to its recent offer to buy back debt worth $130 million (Rs 1,063.9 crore).

APSEZ’s plan to prepay $130 million of debt is an attempt on its part to boost investor confidence about its liquidity position after being rocked by a US short-sellers report in January this year.

Since then, listed companies of the conglomerate have recovered partially following its move to pay off the debt that was taken by pledging shares and an infusion of nearly $1.90 billion by GQG Partners.

APSEZ last month floated a tender to buy back as much as $130 million or Rs 1,064 crore and similar amounts in the next four quarters of its outstanding 3.375 per cent senior notes due in 2024. The buyback programme for these bonds closed on May 8.

The company disclosed in a regulatory filing that bondholders have validly tendered an aggregate principal amount of $412.7 million.

"Since the principal amount of notes validly tendered and not validly withdrawn on or before the early tender date (of May 8) exceeded the maximum acceptable amount of $130 million in aggregate principal amount of the outstanding notes, the company will accept such notes for purchase subject to the proration factor of 34.2649 per cent," it said.

"The purpose of the tender offer is to partly prepay the company's near-term debt maturities and to convey the comfortable liquidity position," it had said in a statement last month.

In addition to the principal amount, the company will pay accrued interest, in respect of any notes purchased in the tender offer from, and including, the last interest payment date.

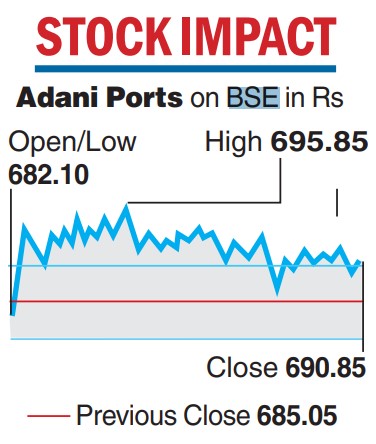

The APSEZ share on Tuesday closed with gains of 0.85 per cent or Rs 5.80 at Rs 690.85 on the BSE after its announcement.

Following the company’s announcement to prepay the debt, global rating agency Standard & Poor’s said that it is an "opportunistic exchange’’, reflecting APSEZ's proactive management of upcoming debt maturities in advance.