Adani Ports and Special Economic Zone (APSEZ) on Monday said that it will prepay $195 million of bonds as the conglomerate shakes off the allegations made by a US short-seller in January.

APSEZ said in a regulatory filing that it will buy back (prepay) the bonds due in July 2024 using its cash reserves.

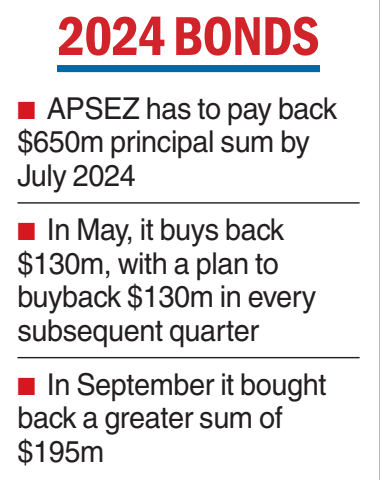

APSEZ had prepaid $130 million of the principal sum of $650 million in May. In the second round, it prepaid another $195 million of the $520 million outstanding.

In a regulatory filing, APSEZ said the company’s board “has approved tranche II of the tender offer to purchase for cash up to $195 million in aggregate principal amount of the outstanding 3.375 per cent senior notes due 2024 which represents 30 per cent of the principal amount of the notes.”

During the first round of buyback in May, APSEZ had said it would buy back 20 per cent of the $650 million principal ($130 million) for five consecutive quarters.

The buyback sum of $195 million makes up 30 per cent of the outstanding sum

and exceeds sum due to be prepaid.

Adani Ports said the buyback tender is open till October 26. The total consideration for each $1,000 principal amount of notes purchased will be $975 per $1,000 principal amount of the note.

Badly hit by the allegations made by Hindenburg in January, the Adanis have been trying to make a comeback through the pre-payment of debt and raising funds from overseas investors such as GQG Investment Partners.

The US-based short seller had accused it of accounting fraud and stock manipulation. The group has denied all the allegations.

The company has engaged Barclays Bank, DBS Bank, Emirates NBD Bank PJSC, First Abu Dhabi Bank PJSC, Mizuho Securities (Singapore) Pte Ltd, MUFG Securities Asia Singapore Branch, SMBC Nikko Securities (Hong Kong) and Standard Chartered Bank to serve as deal managers for the offer.

Adani Ports was in the news when the promoter group increased its stake in the company from 63.06 per cent to 65.23 per cent.

Stock exchange filings showed promoter group firms Resurgent Trade and Investment Ltd buying almost 1 per cent stake in the firm while another 1.2 per cent was purchased by Emerging Market Investment DMCC.

In August, GQG increased its stake in Adani Ports to 5.03 per cent through market purchases. GQG now has a stake in five of the 10 Adani group firms.

On August 16, GQG bought a 7.73 per cent stake in group firm Adani Power Ltd. The two promoter group firms Worldwide Emerging Market Holding and Afro ASIA Trade and Investments had sold an 8.09 per cent stake in Adani Power through block deals.