The Adani group has pre-paid $1.114 billion or Rs 9,200 crore of loans taken against pledged shares as part of a move to prepay all sharebacked financing in the wake of the damaging allegations of US short-seller Hindenburg.

Adani is trying to assuage concerns over margin calls given the sell-off in group shares after Hindenburg released its report on January 24. A group statement released on Monday said the promoters have prepaid $1,114 million ($1.1 billion) of loans ahead of their maturity in September 2024 “in light of recent market volatility and in continuation of the promoters’ commitment to reduce the overall promoter leverage backed by Adani listed company shares’’.

The loans were taken by pledging the shares of Adani Ports & Special Economic Zone (APSEZ), Adani Green Energy and Adani Transmission. With the payment, the lenders in APSEZ will release close to 168.27 million shares, representing 12 per cent of the promoter holding in the company.

In Adani Green, they will release 27.56 million shares or 3 per cent of the promoter stake and in Adani Transmission, 11.77 million shares or 1.4 per cent of holding. The promoters held a 65.13 stake in APSEZ, 60.75 per cent in Adani Green and 74.19 per cent in Adani Transmission as on December 31.

Reports say the Adanis intend to bring down such share-backed funding to zero over the next 45 days. It is not immediately clear as to how the promoter family funded the prepayment. Analysts at JP Morgan estimated that while there are $1.8 billion of promoter-level loans, aggregating all share pledges at the various listed entities, the pledged value stands at $5.2 billion.

Last week, State Bank of India (SBI) chairman Dinesh Khara said that while the country’s largest bank has an exposure of Rs 27,000 crore to the group, none of these are in the form of loans against shares. Bank of Baroda has also said that it has total exposure of Rs 7,000 crore, which is fully secured. In the meantime, attempts by the regulators and even the government to instil confidence in the broader market have not proved to be a fruitful exercise.

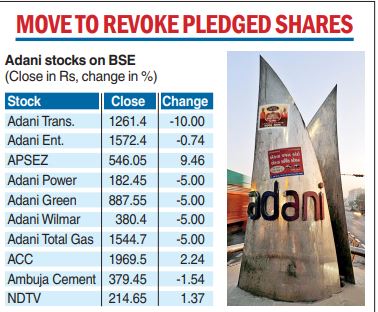

The benchmark Sensex fell almost 335 points on Monday with the Adani factor an overhang on the market, while all but four group stocks ended in the red. While the Adani Transmission share crashed 10 per cent to hit the lower circuit at Rs 1,261.40 on the BSE, Adani Green Energy hit the lower circuit of 5 per cent at Rs 887.55.

Adani Power, Adani Total Gas and Adani Wilmar also met with the same fate as they all fell five per cent. On the other hand, flagship Adani Enterprises witnessed volatility as it crashed more than 9.50 per cent to an intra-day low of Rs 1,433.60.

Though it bounced back from these levels, the counter ended with losses of 0.74 per cent at Rs 1,572.40. Adani Ports stole the show for the group as it rallied 9.46 per cent or Rs 47.20 to close at Rs 546.05 on the BSE. The other two gainers were ACC and Ambuja Cements which ended higher by 2.24 per cent and 1.54 per cent, respectively.

NDTV, the media arm, rose 1.37 per cent. At the close of trade, the listed shares had a combined market cap of nearly Rs 9.81 trillion against Rs 10.08 trillion last Friday. On January 24, they had a market cap of over Rs 19 trillion.