The Adani Group has scrambled again to douse the flames from a second exposé of questionable financial transactions, dubbing the latest revelations as “recycled allegations” and a “concerted bid... to revive the meritless Hindenburg report”.

But the revelations from the Organised Crime and Corruption Reporting Project (OCCRP) — a network of investigative journalists that collaborated with the London-based Financial Times and The Guardian to publish a report — go well beyond

the accusations made by US short-seller Hindenburg Research on January 24, which precipitated a $100-billion meltdown in the market valuation of the Adani group in February.

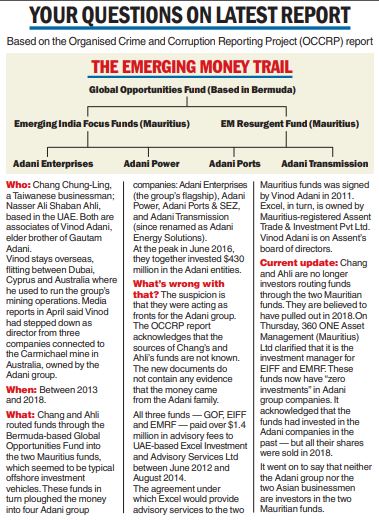

The OCCRP report claims that two Asian businessmen — Nasser Ali Shaban Ahli from the United Arab Emirates and Chang Chung-Ling from Taiwan — had conspired to funnel funds through two Mauritius-based investment funds into the stocks of four Adani group companies.

The latest exposé marks the first time that the identities of the shadowy people who held stock in Adani companies have been revealed.

The report claims that Ahli and Chang “spent years buying and selling Adani stock through offshore structures that obscured their involvement”. They also made considerable profits in the process.

Ahli and Chang are close associates of Vinod Adani, elder brother of the private conglomerate’s founder, Gautam.

The Hindenburg report did not speak about Ahli and merely said that Chang was one of several people involved in routing funds into Adani group entities through a firm called Monterosa Investment Holdings and five independent investment funds that it controlled.

Weak rebuttal

The Adani rebuttal skirts this principal issue and hares off in a different direction.

The group tried to rubbish the OCCRP report on the ground that a part of it relies on a case filed by the Directorate of Revenue Intelligence (DRI) against Adani Power for over-invoicing the import of power generation equipment in 2014.

“There was no over-valuation,” the Adani statement said. “The matter attained finality in March 2023 when the Hon’ble Supreme Court of India ruled in our favour.”

The Hindenburg report had prompted the Supreme Court to order two separate investigations by a panel of court-appointed experts and market regulator Sebi.

The experts’ panel, which submitted its report to the apex court in May, claimed that its inquiry had “hit a wall” because of a chicken-and-egg situation that had arisen after the regulations governing foreign portfolio investors (FPIs) was diluted in 2019 and it was no longer possible for Sebi to lift the veil to reveal the identity of those routing investments into India through offshore funds.

Last week, Sebi submitted a status report to the Supreme Court but its findings are not known.

The Adanis are trying to claim that the charges against them do not stick because the experts’ panel did not find any regulatory lapse on the part of Sebi — which is a twisted way of absolving itself of a charge when no clean chit was given.

Based on the expert panel’s report, the Adani group claimed on Thursday: “There is no evidence of any breach of minimum public shareholding (MPS) requirements or manipulation of stock prices.”

Trove of documents

The OCCRP report claims to have unearthed files from multiple tax havens, bank records and internal Adani group emails that shed light on the identity of the investors lurking behind the “secretive offshore structures”.

Sebi had been investigating 13 offshore entities — 12 FPIs and one foreign entity — and claimed last week in the 15-page information docket on its status report that “establishing the economic interest shareholders of the 12 FPIs remains a challenge”.

The regulator said its investigations were hampered because it had yet to “gather details” from five unnamed foreign jurisdictions.

The OCCRP report, however, said that the reporters had found a money trail that led to “a pair of Mauritius-based investment funds”: Emerging India Focus Funds (EIFF) and EM Resurgent Fund (EMRF).

It claimed that Ahli and Chang placed a lot of money into these funds which were then funnelled into “four Adani companies between 2013 and 2018”.

“At one point in March 2017, the value of investments in the Adani Group stock was $430 million,” the report added.

Tracing a convoluted money trail, the OCCRP report said the funds were channelled through “four companies and a Bermuda-based investment fund called the Global Opportunities Fund (GOF)”.

The four companies were Lingo Investment Ltd, based in the British Virgin Islands and owned by Chang; Gulf Arij Trading FZE of the UAE, owned by Ahli; Mid East Ocean Trade (Mauritius) in which Ahli was the beneficial owner; and Gulf Asia Trade & Investment Ltd (BVI) where Ahli was the “controlling person”.

EIFF and EMRF held between 8 and 14 per cent in four Adani companies — group flagship Adani Enterprises, Adani Power, Adani Ports and Adani Transmission — at the peak of their investment in June 2016.

Puppets on a chain

Quoting sources, the report claimed that the fund managers in charge of Chang and Ahli’s investments in EIFF and EMRF received direct instructions on the investments from an Adani company, Excel Investment and Advisory Services Ltd, which is based in a secretive offshore zone in the UAE “where corporate records are not available”.

The report said the reporters had found an agreement signed by Vinod Adani in 2011 that promised that Excel would provide “advisory services to EIFF and EMRF”.

Excel, in turn, was owned by a company called Assent Trade & Investment Pvt Ltd. An email dated 2016 stated that Vinod Adani and his wife were the ultimate owners of Assent Trade.

Invoices and transaction records also showed that EIFF, EMRF and the Bermuda-based GOF paid over $1.4 million in advisory fees to Excel between June 2012 and August 2014.

Caveat

There is, however, a caveat here. The report says: “There is no evidence that Chang and Ahli’s money for their Adani Group Investments came from the Adani family. The source of the funds is unknown.”

But the OCCRP also claimed that Vinod Adani used “one of the same Mauritius funds to make his own investments”.

Legal hassles

Chang and Ahli were embroiled along with the Adani family in two separate government investigations into “alleged wrongdoing by the Adani group”.

Both cases were eventually dismissed.

The first of the cases related to an allegedly illegal diamond trading scheme that was investigated by the DRI.

A DRI report had said Chang was a director of three Adani group companies involved in the scheme while Ahli represented a trading firm that was also under the radar.

The second case was an alleged over-invoicing scam, revealed in a separate 2014 investigation. It was alleged that the Adani group had siphoned money out of India by overpaying a foreign subsidiary by as much as $1 billion for imported power generation equipment.

Reporters who were part of the OCCRP-led investigation into the Adani group had obtained a letter that the DRI had sent to Sebi in 2014 claiming that the agency had evidence that money from the alleged over-invoicing scheme had been sent to Mauritius.

The DRI case was that money from the alleged scheme was sent to an Emirati company called Electrogen Infra FZE. This company forwarded the proceeds of about $1 billion to a Mauritius-based company ultimately owned by Vinod Adani that had a similar name: Electrogen Infra Holding Pvt Ltd.

The OCCRP claimed that “reporters were able to trace the onward flow of over $100 million of these funds”.

In turn, this Mauritius company loaned the money to another Vinod Adani company, Assent Trade & Investment Pvt Ltd, “to invest in the Asian equity market”.

As beneficial owner of both Electrogen Infra Holding and Assent, Vinod Adani signed the loan document as both the lender and the borrower.

Eventually, the money was placed with GOF — the same intermediary used by Chang and Ahli — and then invested in EIFF and Asia Vision Fund, another Mauritius-based investment vehicle.