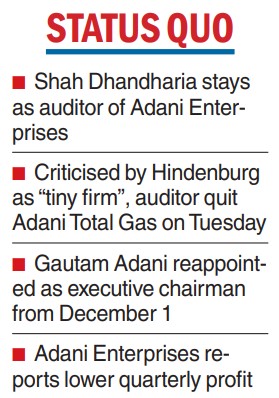

Adani Enterprises Limited has decided to stick with its auditor Shah Dhandharia & Co — strafed by the Hindenburg report — days after the firm quit as the auditor of Adani Total Gas.

The group flagship has approved the reappointment of Gautam Adani as its executive chairman for a period of five years from December even as net profit attributable to the owners of the company fell almost 12 per cent on a sequential basis in the fourth quarter to Rs 722.48 crore from Rs 820.06 crore.

On Tuesday, Shah Dhandharia had quit as the statutory auditors of Adani Total citing limited time because of other audits — which queered the pitch for the auditor staying on at Adani Enterprises.

In its scathing report on the Adani group, US-based short seller Hindenburg had raised questions on the size and capability of the “tiny firm’’ Shah Dhandharia.

The Adani group had defended the appointment saying all the auditors engaged by them have been duly certified and qualified by the relevant statutory bodies.

While a regulatory filing from AEL did not contain any disclosure about the resignation of its statutory auditors, the flagship announced that its board on the recommendation of the nomination and remuneration committee has approved the re-appointment of Gautam Adani as the executive chairman with effect from December 1 for five years.

Adani’s present term expires on November 30, 2023.

The group flagship reported a consolidated net profit of Rs 772.48 crore in the fourth quarter on revenue from operations at Rs 31,346.05 crore.

Net profit stood at Rs 304.32 crore a year ago against a revenue of Rs 24,865.52 crore.

Though net profit rose on a year-on-year basis, it dropped sequentially.

The company reported an exceptional item of Rs 369 crore, including expenses of Rs 71.67 crore incurred in its follow-on public offering (FPO) which closed on January 31, 2023. The FPO was withdrawn by the conglomerate despite being fully subscribed.

The company said one of the subsidiaries of the group, Mundra Solar PV Ltd, upgraded its manufacturing facility with “TOPCon’’ technology in the fourth quarter.

Mundra Solar is now in the process of discarding its existing plant and machinery pending which the identified assets have been classified as ‘’non-current assets classified as held for sale’’ at a fair value of Rs 100 crore.

It said Mundra Solar has a recognized loss of Rs 309.41 crore after adjusting unamortised government grant.

Myanmar port sold at a loss

Bangalore: Adani Ports and Special Economic Zone Ltd said on Thursday that it has completed the sale of its port in sanction-hit Myanmar for $30 million, significantly lower than its investment in the project.

The Adani group company announced the sale in May 2022 after a military coup in Myanmar and an ensuing crackdown on mass protests drew international ire and US sanctions. The deal was, however, delayed due to challenges in meeting certain conditions including completion of the project.

Filings from May 2021 showed that the company invested $127 million in the project, including a $90 million upfront payment to lease land.

Inputs from key minority shareholders were a key driver in the company’s decision to exit the project.

Reuters