There’s a new player in town, and it’s called BNPL. Buy Now Pay Later loans are not a recent invention. However, considering the economic difficulties caused by the pandemic, they are becoming increasingly popular.

While people have struggled with income stability and had to dip into their savings for sustenance, it’s also become tougher for some to avail of other forms of credit. For example, without stable income and repayment of other loans, it is tough to avail of a fresh personal loan.

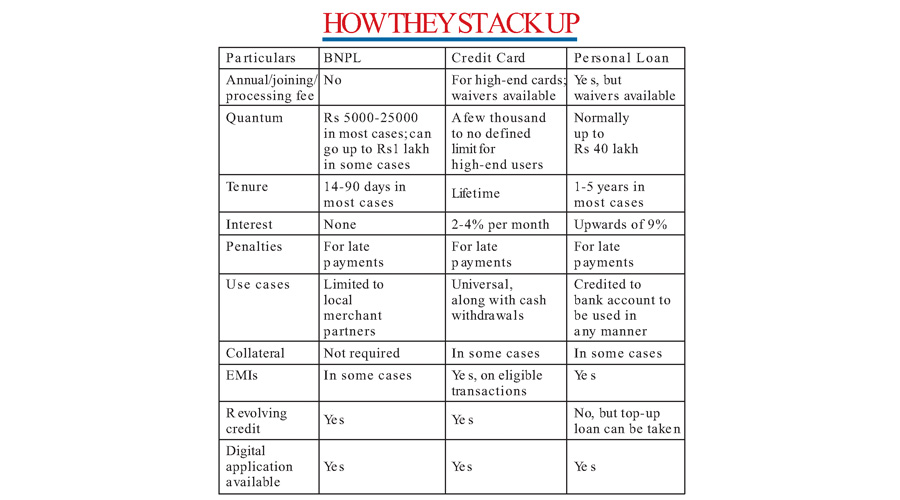

Therefore, there’s a need for a short-term credit solution that can be availed of without hassle and be repaid without charges. Think of it like maintaining a tab with your local grocer: at the end of a month, you make a bullet payment to clear your dues, and there is no interest or processing fee. In fact, you may get a small discount for paying on time. As you head into the festive season, you’re going to hear about your borrowing options. So let’s look at BNPLs and how they compare to other forms of unsecured credit.

What is BNPL?

BNPLs have been around for some years and you would have seen them on as a ‘payment’ option on taxi aggregators, online groceries or food delivery services. In a BNPL loan, you are provided micro-credit — Rs 5,000 to Rs 25,000 in most cases — and you need to repay the dues within 14-90 days. The loan is interest-free. There are no processing fees or renewal fees either, but only a penalty for late payments. You can avail one quickly from your preferred BNPL provider. BNPLs are now visible on a number of online services. Though the number of use cases they currently have are low, but the number of merchants being onboarded by lenders is rapidly rising.

Why is it gaining popularity

The global BNPL market was valued at $7.3 billion in 2019 and is expected to grow to $33.6 billion by 2027, according to one market survey. The Q4 2020 BNPL Survey says that in India, the gross merchandise value will rise to $52.8 billion by 2027. The rapid rise of BNPLs in India coincides with pandemic-linked loss of income as well as the public going online for every necessity, be it paying bills or buying groceries. Many fintech lenders now offer BNPLs and a couple of large private banks have also entered the fray.

Availing a BNPL

Unlike bank loans where credit score and income checks are necessary in loan underwriting processes, BNPLs are less stringent. BNPLs can be availed online with minimal paperwork or without even having to meet the lender. It’s a good option for new-to-credit borrowers, especially those yet to take credit cards. Once you’ve signed up for a BNPL, you need to link the account to the merchant you want to shop with, and use the BNPL as your payment option while completing your purchase.

Credit card vs BNPL

The similarities between the two are ease of access and use, revolving credit, and an interest-free window. But there are many differences. Credit cards may allow much higher spending limits compared to BNPL which may go up to only Rs 1 lakh in a few cases.

In BNPLs, late payments attract penalties but not interest charges, except for EMI BNPLs where interest may apply. Cards charge both penalties and interest. Cards are universally accepted, online or offline, in India or globally.

BNPLs can only be used with merchants linked to the lender on specific platforms. Cards also come with loads of rewards, cashbacks and benefits which can enhance the borrower’s lifestyle, but BNPLs largely do not have rewards.

Cards allow cash withdrawals at additional interest charges; BNPLs don’t.

Personal loans vs BNPL

Personal loans can be as large as Rs 40 lakh in some cases, and can be repaid with interest over tenures of up to five years. BNPLs are micro-credits with much shorter tenures and without interest. Loans are deposited to your bank from where you can spend the money according to your need, even as cash. BNPLs remain with your lender who settles bills on your behalf with partnering merchants. Personal loans are one-time loans while BNPLs, like credit cards, can be used repeatedly from your approved loan balance as long as you keep repaying your dues.

BNPLs, credit cards, and personal loans are various forms of unsecured credit, each with its own unique benefits. Borrowers with good credit profiles will get plenty of offers for these in the festive season. But any form of credit needs to be used with financial discipline. Users must not over-borrow, and should minimise their use for funding lifestyle and consumption.

BNPL sign-ups normally don’t require a hard credit check, which can slightly lower your credit score. However, late payments are sure to harm your score. Therefore, borrowers must ensure they read the terms and conditions carefully, borrow thoughtfully, and always repay their dues in time.

The writer is CEO, BankBazaar.com