Steel major AM/NS India has reported a 62.75 per cent slump in EBIDTA (earnings before interest, depreciation, tax and amortisation) in the fourth quarter of 2022 on account of lower shipments and a fall in the sales price.

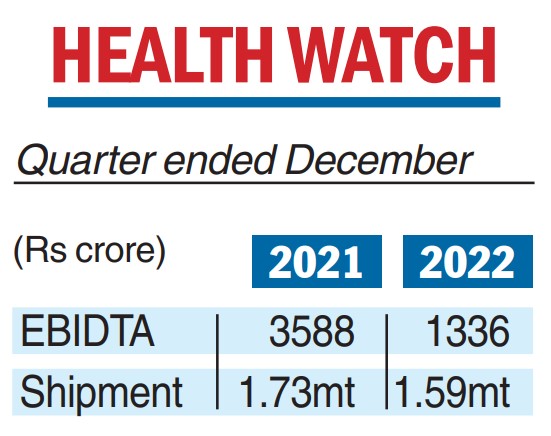

The company, formerly Essar Steel, had recorded earnings of $162 million (around Rs 1,336.5 crore) during the October-December period, compared with $435 million (Rs 3,588 crore) in the corresponding period of 2021.

Production at 1.62 million tonnes (mt) was lower by 12.1 per cent compared with a year ago because of lower exports following the imposition of a duty from India in May. The duties were removed from the end of November 2022.

Steel shipment stood at 1.59mt, 8 per cent lower than 1.73mt recorded in the same period of 2021.

On a sequential basis, the EBIDTA showed a downward trend, falling from $204 million in the Q3 of 2022. Shipment decreased 2.5 per cent compared with the trailing quarter.

On a full-year basis, the company where ArcelorMittal holds 60 per cent of equity, recorded $1201 million (Rs 9,908 crore) EBIDTA in 2022, compared with $1996 million (Rs 16,467 crore) in 2021.

AM/NS India said it is investing $1 billion (Rs 8,250 crore) in value-added downstream units, focusing on demand from the auto sector. They will be commissioned by July 2024.

Moreover, the first phase expansion of upstream steel-making capacity to 15mt at Hazira is underway and expected to be completed by early 2026, while de-bottlenecking the capacity to 8.6mt will be ready by end of 2024.

The company said it has completed the acquisition of Essar Group port, power and other logistics and infrastructure assets in India for $2.4 billion.

AM/NS financial numbers were disclosed as part of ArcelorMittal’s fourth quarter and annual results publication. The steel behemoth reported $1,258 million in EBIDTA and $261 million in net income in Q4 compared with $5,052 million and $4,045 million, respectively, in the Q4 of 2021.

Aditya Mittal, ArcelorMittal chief executive officer, said: “Despite the challenges that emerged as the year unfolded, our full-year results demonstrate the benefits of our strengthened asset portfolio.”