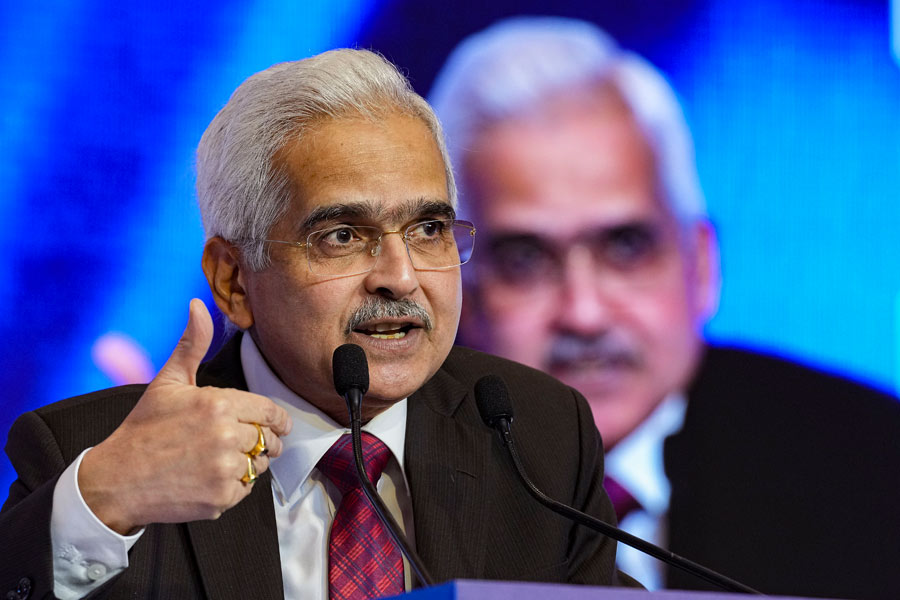

Around 50 per cent of the Rs 2000 notes in circulation have come back to the banking system of which close to 85 per cent have been parked as deposits in banks, RBI governor Shaktikanta Das said on Thursday.

The RBI on May 19 announced the withdrawal of the Rs 2,000 notes as part of its clean notes policy. It allowed the holders of these notes to deposit them in their bank accounts or exchange into other denominations up to a limit of Rs 20,000. The total value of these notes in circulation stood at Rs 3.62 lakh crore as on March 31, 2023.

Das urged the public not to panic during the exchange or deposit of Rs 2,000 notes. He advised against turning up at the last minute.

He said there was no plan to withdraw Rs 500 notes or re-introducing Rs 1,000 currency. Last month, Dassaid the RBI expected most of the Rs 2,000 currency notes to be returned by the September 30 deadline.

Fraud a/cs

The RBI will “shortly” come out with revised guidelines on fraudulent account classification to take into account the recent apex court order that asked lenders to ensure natural justice to a defaulter before labelling him a fraudster.

“The SC has given a judgement, saying natural justice has to be provided to a borrower before declaring him a fraud.

“Subsequently, hearing a review petition filed by SBI, the apex court clarified that there was no need to give a personal hearing,” Mukesh Jain, the deputy governor in charge of banking supervision, said.

Investment appetite on the rise

Mumbai: Surveys conducted by the RBI show manufacturing companies are having higher investment intentions in this financial year, RBI governor Shaktikanta Das said.

This comes after manufacturing activity rebounded in the fourth quarter of 2022-23 resulting in real GDP growth in Q4 rising to 6.1 per cent from 4.5 per cent in the third quarter of the fiscal.

``Fixed investment by manufacturing companies expanded in 2022-23, reversing the contraction seen in 2021-22. Our surveys also point towards higher investment intentions of manufacturing companies for 2023-24,’’ Das said in a televised address after the monetary policy committee (MPC) retained the policy repo rate at 6.5 per cent.

The domestic economy is resilient, given the healthy balance sheets of banks and corporates, supply chain normalisation and declining uncertainty.

The conditions are, therefore, favourable for the capex cycle to gain momentum.

He said robust government capital expenditure is also expected to nurture investment and manufacturing activity.

OUR SPECIAL CORRESPONDENT