More than 130 nations agreed on Friday to a sweeping overhaul of international tax rules, with officials backing a 15 per cent global minimum tax and other changes aimed at cracking down on tax havens that have drained countries of much-needed revenue.

The Organization for Economic Cooperation and Development, which has been leading the negotiations, said 136 countries and jurisdictions had signed on to the deal.

“Today’s agreement will make our international tax arrangements fairer and work better,” Mathias Cormann, the organization’s secretary general, said in a statement. “We must now work swiftly and diligently to ensure the effective implementation of this major reform.”

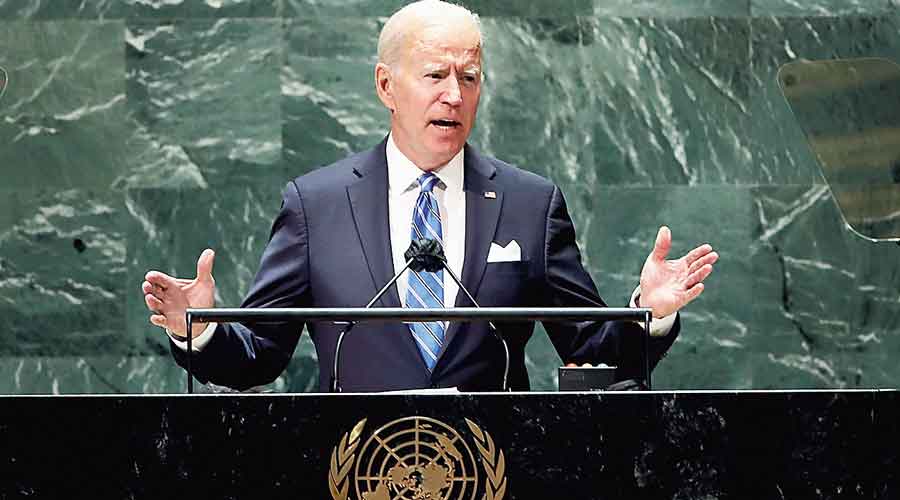

The agreement is the culmination of years of fraught negotiations that were revived this year after President Biden took office and renewed the United States’ commitment to multilateralism. Finance ministers have been racing to finalise the agreement, which they hope will reverse a decades-long race to the bottom of corporate tax rates that have encouraged companies to shift profits to low-tax jurisdictions, depriving nations of money they need to build new infrastructure and combat global health crises.

On Friday, Hungary, which had sought sweeter terms, agreed to back the new tax, joining two other important holdouts, Ireland and Estonia, which ratified the deal on Thursday.

The agreement to enact a 15 per cent minimum corporate tax rate had been proposed by the United States, which has long looked for ways to minimise incentives for companies to shift profits abroad to lower their tax bills. As the Biden administration prepares to try and raise corporate tax rates in the United States, getting a global minimum tax in place has become critical to prevent companies from simply shifting their headquarters overseas.

The deal goes beyond setting a global minimum tax — it also creates new rules for the digital era. Under the agreement, technology giants like Amazon, Facebook and other big global businesses will be required to pay taxes in countries where their goods or services are sold, even if they have no physical presence there.

The accord would represent a sea change in the way the world’s largest corporations have been taxed for decades, and is likely to see them pay more taxes while spreading taxable revenue more evenly to countries where those businesses earn sales. Until now, profits have largely been taxed where businesses have had a physical presence.

New York Times New Service