The net profit of Reliance Industries missed analyst estimates for the fourth quarter but the company crossed a major milestone — becoming the first from India to achieve $100 billion in annual revenues.

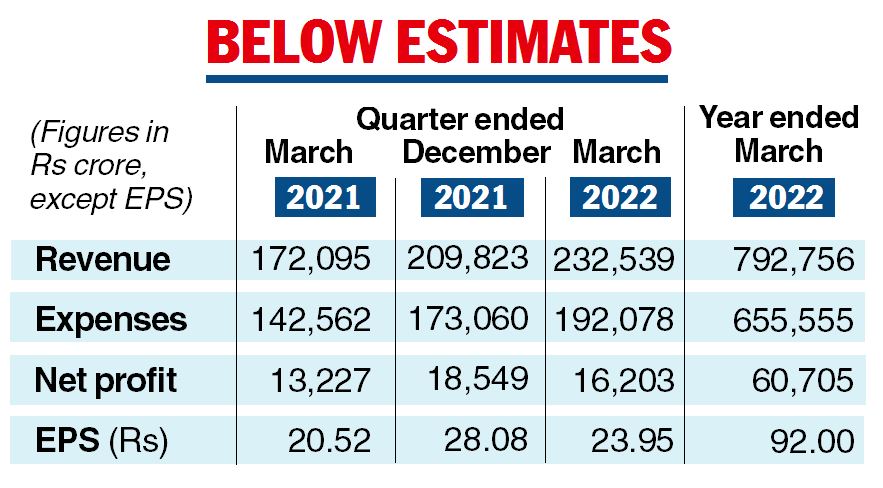

RIL posted a 22.50 per cent rise in consolidated net profit for the quarter ended March 31, 2022 to Rs 16,203 crore from Rs 13,227 crore in the corresponding period of the previous year.

Brokerages had forecast net profit between Rs 16,300 crore and Rs 16,900 crore. The consensus estimate of Bloomberg analysts put the net profit at Rs 16,819 crore. Consolidated revenues for FY22 rose 47 per cent to Rs 792,756 crore ($104.6 billion) against Rs 539,238 crore a year ago. Net profits rose 26 per cent to Rs 67,845 crore from Rs 53,739 crore in 2020-21. Net profit attributable to owners of the company rose to Rs 60,705 crore in FY 2022.

The quarterly numbers showed retail business to post a strong growth, while oil-to-chemical (O2C) was affected by challenges such as high energy cost even as the telecom segment was a let-down.

The O2C business saw consolidated revenues rising 44.2 per cent to Rs 145,786 crore from Rs 101,080 crore in the year-ago period while the segment earnings before interest, taxes, depreciation & amortisation (EBITDA) rose almost 25 per cent to Rs 14,241 crore from Rs 11,407 crore in the corresponding period of the previous year.

EBITDA margins took a knock of 150 basis point to 9.8 per cent. The conglomerate blamed this on the base effect driven by high feedstock and product prices.

Reliance Retail recorded a solid show with gross revenues rising over 23 per cent during the quarter to Rs 58,017 crore from Rs 47,064 crore a year ago.

While the margins were stable, EBITDA from operations gained 16.3 per cent to Rs 3,584 crore from Rs 3,083 crore. RIL said the business delivered its best-ever quarterly revenues despite the challenges posed by the spread of the Omicron and from coming out of a festive quarter.

Retail reported gross revenue of Rs 199,704 crore in FY22, a growth of 26.7 per cent over the previous year driven by broad based growth across all consumption baskets.

EBIDTA in the retail business crossed Rs 12,000 crore to reach Rs 12,381 crore, a growth of 26.5 per cent over the previous year driven by a strong revenue performance across all consumption baskets.

RIL’s telecom arm Reliance Jio Infocomm Ltd (RJIL) disappointed with net profits coming at Rs 4,173 crore against Rs 3,360 crore in the same period of the previous year and marginally below estimates of some analysts. Its revenues rose to Rs 20,901 crore from Rs 17,358 crore a year ago.

Jio Platforms, which represents RIL’s digital services business, saw gross revenues rising 20.7 per cent to Rs 26,139 crore from Rs 21,650 crore a year ago. Average revenue per user during the quarter rose to Rs 167.6 per subscriber per month from Rs 151.6 per subscriber per month in the preceding three months.

For the year ended March 31, 2022, RIL’s outstanding debt at Rs 266,305 crore was higher than its cash and cash equivalent of Rs 231,490 crore.

“Despite the ongoing challenges of the pandemic and heightened geo-political uncertainties, Reliance has delivered a robust performance in 2021-22. I am pleased to report strong growth in our digital services and retail segments. Our O2C business has proven its resilience and has demonstrated strong recovery despite volatility in the energy markets,’’ Mukesh Ambani, chairman and managing director, RIL, said on the results.

“Our relentless focus on customer satisfaction and service has led to higher engagement and increased footfalls, driving robust revenue and earnings figures across our consumer businesses. The gradual opening up of economies coupled with sustained high utilization rates across sites and the improvement in transportation fuel margins and volumes have bolstered our O2C earnings,’’ Ambani said.