The government on Friday announced four separate mergers of public sector banks in which 10 lenders will combine to form a quartet of new entities, with the aim to create world-class banks with stronger balance sheets and more lending power.

Finance minister Nirmala Sitharaman said following the four mergers, the number of state-owned banks will reduce to 12. There would be no retrenchment during or after the merger process, the government said.

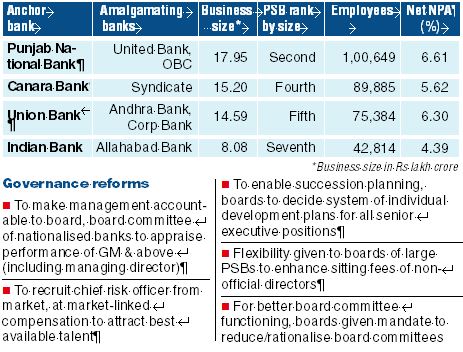

She announced that Punjab National Bank, Oriental Bank of Commerce and United Bank of India will combine to form the nation’s second-largest lender; Canara and Syndicate Bank will merge; Union Bank of India will amalgamate with Andhra Bank and Corporation Bank; and Indian Bank will merge with Allahabad Bank.

“Twelve solidly present, well-consolidated, energised, adequately capital-endowed banks will now operate. We’re trying to build the NextGen banks,” Sitharaman said during the news conference.

The biggest consolidation exercise in the Indian banking industry, seen together with the previous two rounds of mergers, will bring down the number of nationalised public sector banks to 12 from 27 in 2017. The 10 banks to be amalgamated constitute 82 per cent of public sector banks’ (PSBs) business and 56 per cent of commercial banks’ business in India.

Oriental Bank of Commerce and United Bank will merge into PNB to create a bank with a business of Rs 17.95 lakh crore and 11,437 branches, Sitharaman said.

The merger of Syndicate Bank with Canara Bank will create the fourth largest public sector bank with a business of Rs 15.20 lakh crore and a branch network of 10,324.

Andhra Bank and Corporation Bank’s merger with Union Bank of India will create India’s fifth largest public sector bank with a business of Rs 14.59 lakh crore and 9,609 branches.

The merger of Allahabad Bank with Indian Bank will create the seventh largest public sector bank with a business of Rs 8.08 lakh crore and strong branch networks in the South, North and East of the country, she said. Bank of India and Central Bank will continue to operate as before.

Last year, the government had merged Dena Bank and Vijaya Bank with Bank of Baroda, creating the third-largest bank by loans in the country.

Rajnish Kumar, chairman of SBI, said the announcement is a cohesive and a clear recognition that bigger banks have that much more ability to absorb shocks, reap economies of scale as well as the capacity to raise resources without depending unduly on the exchequer.

“There will not be any immediate improvement in their credit metrics as all of them have relatively weak solvency profiles. Consolidation will also provide scope for improvement in corporate governance, and the measures announced to improve the functioning of banks’ boards are a step in that direction,” said Srikanth Vadlamani, vice-president of the financial institutions group at Moody’s.

Mona Khetan, banking analyst at Reliance Securities, said: “The consolidation will aid economies of scale for these banks. Nonetheless, merger related issues could impact interim profitability.”

All India Bank Employees’ Association (AIBEA) general secretary C.H. Venkatachalam told The Telegraph “the move is unwarranted and untimely. When the economy is in the doldrums, the government is going for consolidation of banks. Such mega banks would not know what is happening in their backyard as the Nirav Modi fraud is a case in pointer”.

He said, “We have decided to hold massive demonstrations across the country on Saturday and wear black badges as a mark of protest and later decide on the future course of action.”

“The current mergers may face more friction — the mergers are mostly among larger banks, with the absorbing bank not necessarily in strong health,’’ said Prakash Agarwal of India Ratings.

Rajnish Kumar, chairman of SBI, said the announcement is a cohesive and a clear recognition that bigger banks have that much more ability to absorb shocks, reap economies of scale as well as the capacity to raise resources without depending unduly on the exchequer.

``It also underlines the fact that the Government recognizes the importance of a robust banking system in achieving the goal of $ 5 trillion economy as bigger banks will be better armed to meet the credit needs of a fast growing economy like ours… The decision to empower Bank Boards and operational flexibility in hiring from the market will prioritise robust risk management practices in decision making’’, he observed.

After the mergers, the country will have 12 public sector banks, including State Bank of India and Bank of Baroda. Also, Indian Overseas Bank, Uco Bank, Bank of Maharashtra and Punjab and Sind Bank, which have strong regional focus, will continue as separate entities.

”The merger proposals would now be taken to the boards of the banks involved in the amalgamation scheme for approvals. After receiving the bank boards' nod, the prospect would be discussed with the RBI in two phases,” Finance Secretary Rajeev Kumar said.

Kumar also assured that there would no retrenchment during or after the merger process. “We will ensure than bank employees benefit from the merger, and not the other way round,” he added.

This is the first bank consolidation measure since the Modi government's return to power in May earlier this year. During its last tenure, the NDA-led regime had put into motion merger of State Bank of India with its five associate banks and Bharatiya Mahila Bank, followed by the merger of Bank of Baroda, Dena Bank and Vijaya Bank.